As our esteemed Doug Wilde regularly points out, manufacturing isn’t the bellwether it once was of US economic output. We are a nation of users, not makers, now, and Retail is what matters. Unless you live in a well-stocked bunker, it is hard to avoid the focus on retail consumption this time of year. We will soon wrap up the big week of consumption capital in motion from “Black Friday” through “Small Business Saturday”, “Cyber Monday” and “Giving Tuesday”. That last one is of course about giving charity and not presents, but the relentless campaigns in person, by phone, and online have made it feel like one more consumption decision while rummaging through the wallet or purse.

From an investor’s point of view it is increasingly difficult to gauge retail activity because how people shop has shifted significantly in just the last few years. Reporters standing in shopping malls near the Santa villages breathlessly pointing to the crowds and bags does not tell the whole story. Even the viral mayhem videos at discount department stores when the throngs pummel each other to grab the BOGO Alexa-enabled combination teddy bear/espresso machine/lawnmower are entertaining yes, anecdotal mostly, informative not so much.

What we hear again and again is that online is killing traditional retail. For anyone who has walked this Earth for long enough there is actually a little bit of schadenfreude since today’s “traditional retail” killed local merchants and main streets a generation or two previously. We do agree that online shopping has been the weapon of choice to kill off department stores and shopping malls, but this is not some great innovation or revelation. Us oldsters remember Sears, JC Penney, Montgomery Ward and other catalogs where almost anything under the sun was a phone call or mail order away. For families that lived out in the boondocks, that was the only way to access a lot of products, not much different from today where significant portions of the population are not close to “traditional retail”.

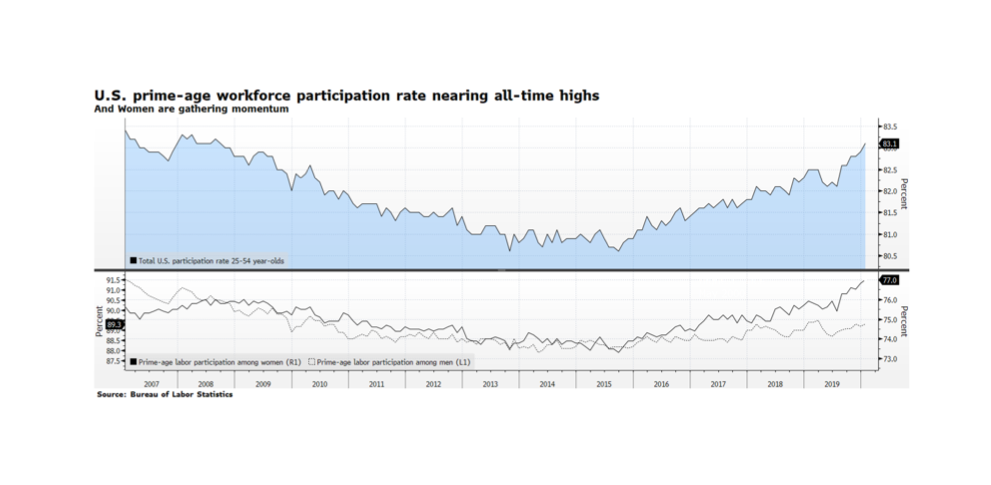

So why do we care as portfolio managers? First, we do want to obtain a clean look at the American consumer as an indicator of the health of our economy. Second, consumption patterns tell us a lot about where growth can be found, and of course has a direct connection not just to the growth of equities of companies all along various supply chains, but to the growth of debt to finance making, selling and consuming. Employment patterns are also closely tied to consumption patterns, particularly during the holiday season.

We see the mix of retail venues changing. Other than automobiles, where the traditional distribution structure is consolidating but not really changing despite Elon Musk’s best efforts, with whom and when people shop is shifting. We can now do a lot of financial damage with an iPhone while wearing footy pajamas and binging The Office. And even through that little 5.5” window, the process of consumption is changing. An influencer on Instagram can hype a product, provide an in-app link, and voila, you are purchasing it with a couple finger taps. The reality now, as we have written before, is that America is simply over-retailed. There are too many places and ways to buy the same products. A lot of the factors that differentiated channels before have dissolved. Price differences have been arbitraged away because of comprehensive access to competitive pricing information. The quest for instant gratification can be satisfied as easily by clicking and waiting by the front door as heading to the mall. Expertise and consultation are more likely to be found online than with the teenaged clerk who is just counting the hours until the shift is over. And when those teenagers do get off work, they aren’t going to roam the malls and food courts themselves to socialize and maybe spend. They may be going home and meeting up with friends through MMO games and even spending those earned dollars leveling up their avatars with swag or new capabilities. How do you measure that in old retail terms?

If people are buying directly from manufacturers’ branded captive websites and catalogs, or through social media, or through major online portals, and of course through bricks-and-mortar stores, how do we get anything resembling a complete much less accurate picture of retail consumption? Some of that insight can come from looking elsewhere in the supply chain. We can consider raw materials, packaging, shipping and logistics, royalties and licensing fees. We can look at volumes through final mile services like UPS and Fedex. We can look at sales tax receipts (although the patchwork of rules around interstate tax collection means this gets you a massive undercount). We can look at hiring, particularly seasonal hiring, which is moving away from retail counters and towards fulfillment centers. We can also look at aggregate transactional data from consumer credit and newer virtualized and peer-to-peer payment methods.

The big issue is that a lot of this data is scattered, not gathered and reported in a timely fashion, and has to be collated and interpreted. Joe the Weatherman reporting from the mall about how long the lines are and how full the bags is not going to do it. We will also look at but retain healthy skepticism about reports from trade groups like the National Retail Federation, which exists to promote the interests of its members. Useful information, but it has to be viewed in the context of its mission and stakeholders. That leaves us the government statisticians, who don’t necessarily have an axe to grind, but the data is lagged and the coverage has not always kept up well with how the retail landscape has changed. The US Census Bureau will be releasing the November 2019 Advance Monthly Retail report on December 13th.

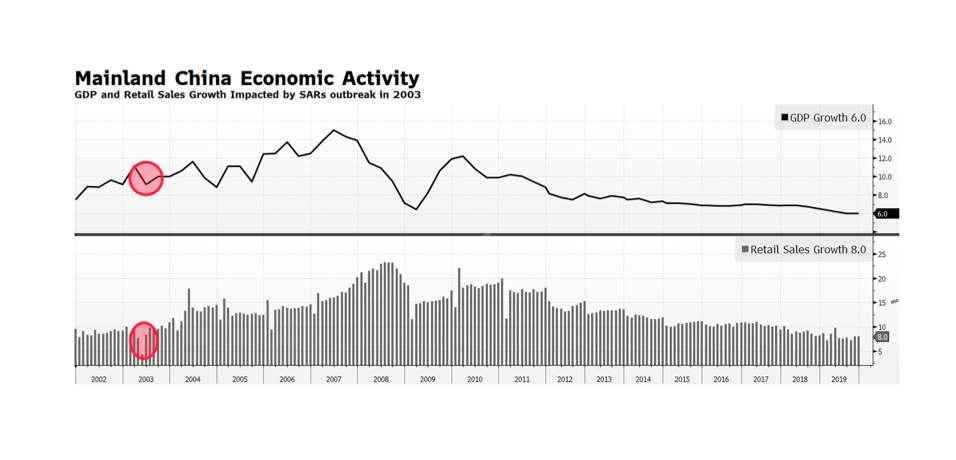

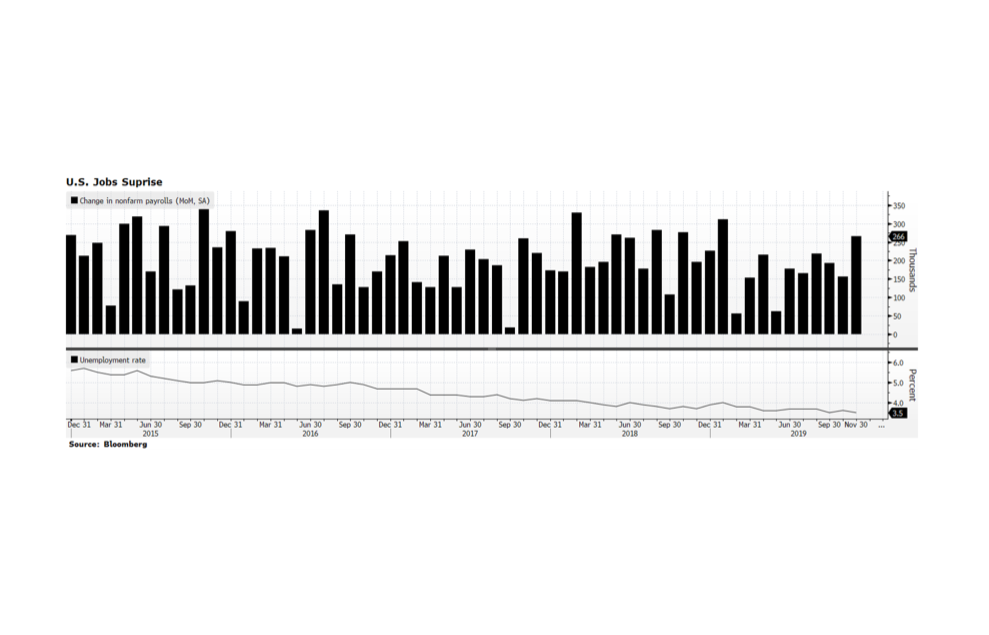

Right now we see the US consumer as reasonably robust. The change in how consumption is taking place means looking elsewhere in the markets to participate in that growth. For instance, instead of REITs that own shopping malls, favor REITs that own warehouses. Look for themes like electronic payments. And of course, trends toward local, organic, fair trade, reclaimed, and other sustainability themes are driving retail flows and even countering the race to the bottom in pricing.

According to the New York Times, more than 90,000 packages a day go missing daily in New York City, and 1.7 million daily nationally. That is clearly a problem on a massive scale. But if that much can go missing or be stolen daily and not break the system or materially drive up costs, the scale of consumption outside of traditional retail store fronts is extraordinary. Maybe this number more than any other is the bellwether indicator we need to watch.