Democracy always feels better when standing on the winning side. PM Theresa May got a sense of that in the British snap election a couple months back. PM Angela Merkel is still struggling to assemble a coalition to govern since losing a controlling majority. In Catalonia, PM Rajoy dissolved the regional government, and members of the dissident leadership found themselves in jail or in exile as he called snap elections. That may have added fuel to the fire as Puigdemont and his cadre campaigned from Belgium, or even prison. A theory had been circulating since the separatist movement succeeded in their earlier referendum on independence that the victory, if even legitimate, was the consequence of a vocal and active minority of the electorate, and the majority of Catalans were with greater Spain. That was undoubtedly part of Rajoy’s calculus in calling the election — let the wheels of democracy turn and reassert the will of the true majority.

In thinking about our portfolios, we are not arguing about the merits of the movement. We are contemplating the implications for Spain and for Europe. The international community has come down on the side of Spanish unity, but in a modern Western democracy, the options are becoming increasingly limited when election after election states that a sizeable portion of the population wants an exit. We think it is unlikely that a program of sanctions or even military action would or could be pursued without creating destabilizing ripples in other regions of Spain and across Europe. If democracy, ugly and painful as it is, is to hold and free markets are to follow, we would anticipate Spanish and European concessions to give Catalonia just enough of what it seeks to make it more attractive to stay than to leave. We see strength in the broad European market and have a long-term view that the Euro will rise, but in the nearer term we could see instability and even retreat in both as concerns about the integrity of the currency come back to the fore and discontent in peripheral Europe puts a tarnish on the economic shine. Germans are having trouble leading the region while they cannot lead themselves, Britain is on its way out, isolationism and nativism are still on the rise, and Macron’s France does not have the economic and political muscle to maintain regional stability on its own. Absent strong, coherent regional leadership, we believe the path to confidence and stability does not begin or end in but certainly runs through Barcelona.

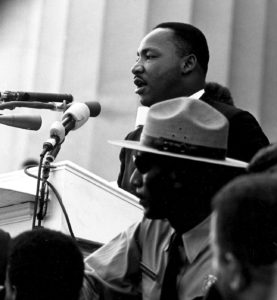

On Dr. Martin Luther King, Jr. Day, it is a good time to listen rather than speak. Here are a few places to go to hear about both the legacy and the present day state of social and economic justice in the United States:

On Dr. Martin Luther King, Jr. Day, it is a good time to listen rather than speak. Here are a few places to go to hear about both the legacy and the present day state of social and economic justice in the United States: