Well, actually regifted from last week’s Facebook, Instagram and LinkedIn postings as a reminder to follow us on social media (link icons on the right of your screen).

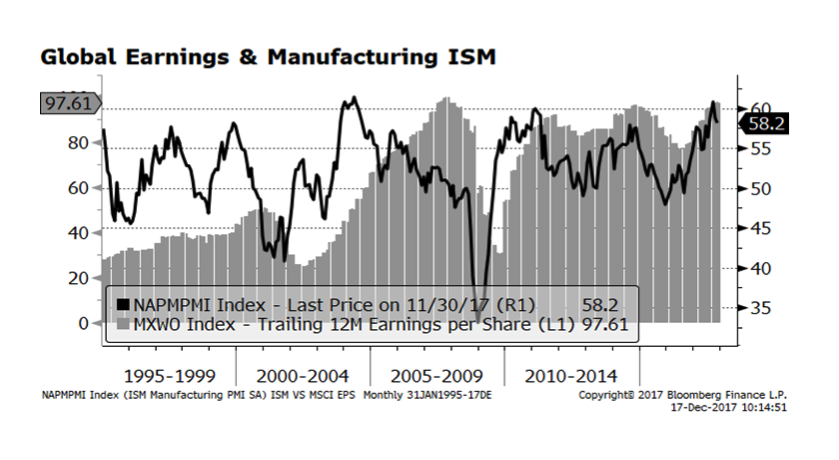

We highlighted this chart back in late October showing the relationship between the US Institute of Supply Management (ISM) Purchasing Managers Index and Global Corporate Earnings. One of the risks we were concerned about then was if tax reform stalled. That risk appears to be behind us as Congress is set to approve the somewhat controversial tax plan.

Several Wall Street investment firms, notably Goldman Sachs and Barclays, have recently increased their forecasts for global GDP growth to 4% based on improving manufacturing survey data and consumer spending trends. The positive impact on global earnings levels should continue to support global equity price levels even with many market valuation metrics full or in some cases stretched. Robust global economic activity is a welcome development but risks still remain including the path of interest rates in several of the G7 bond markets and geopolitical risks associated with the Korean Peninsula and elsewhere.