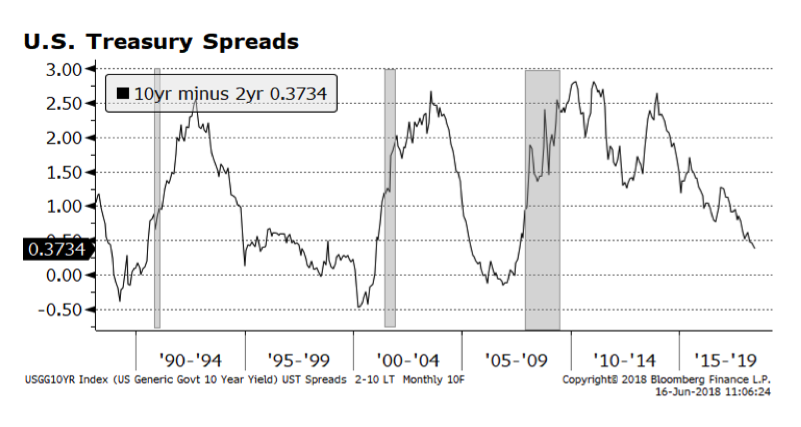

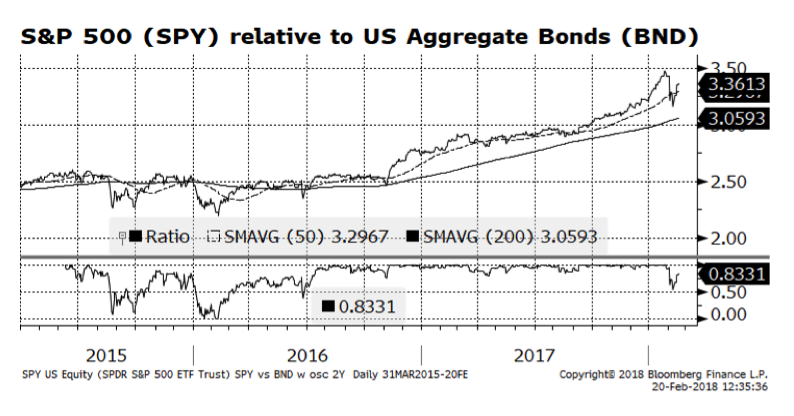

US Treasury Spreads Continue to Narrow

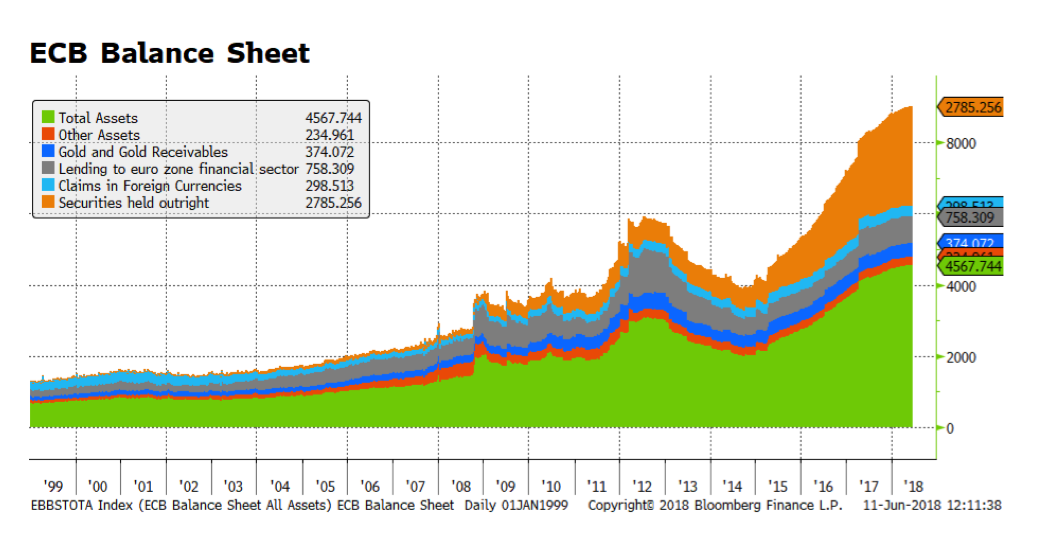

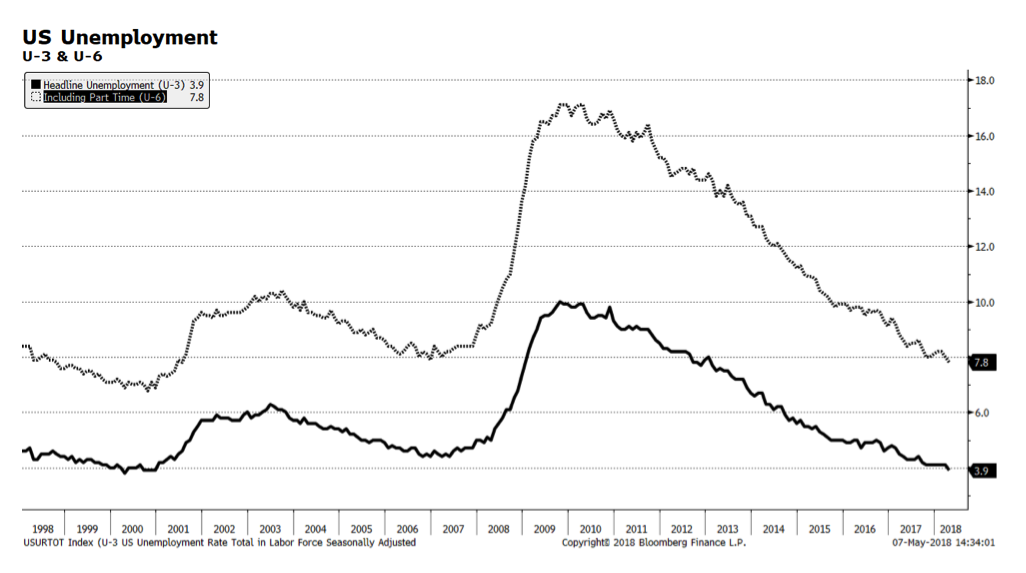

Interest rate spreads in the US Treasury market are continuing — a major concern for investors over the past several quarters. This week’s chart shows the difference between 10-year and 2-year US Treasury yields with the shaded areas marking recessionary periods. As these two yields converge, or when the yield on the 2-year surpasses the 10-year yield, recessions often follow. The current spread is 37 basis points, but it is heading towards parity rapidly. It is difficult to forecast an imminent recession because of the positive trends in employment, consumer and business spending, benign inflation and expansionary fiscal activity. Yet this indicator has strong predictive power and should not be ignored. One major difference in this cycle versus previous ones is the amount of central bank activity throughout the world and as a result treasury spreads might not have the same predictive force as before.

Don’t forget to follow us on Instagram, Facebook and LinkedIn to get the COTW in your social media feed.

Don’t forget to follow us on Instagram, Facebook and LinkedIn to get the COTW in your social media feed.