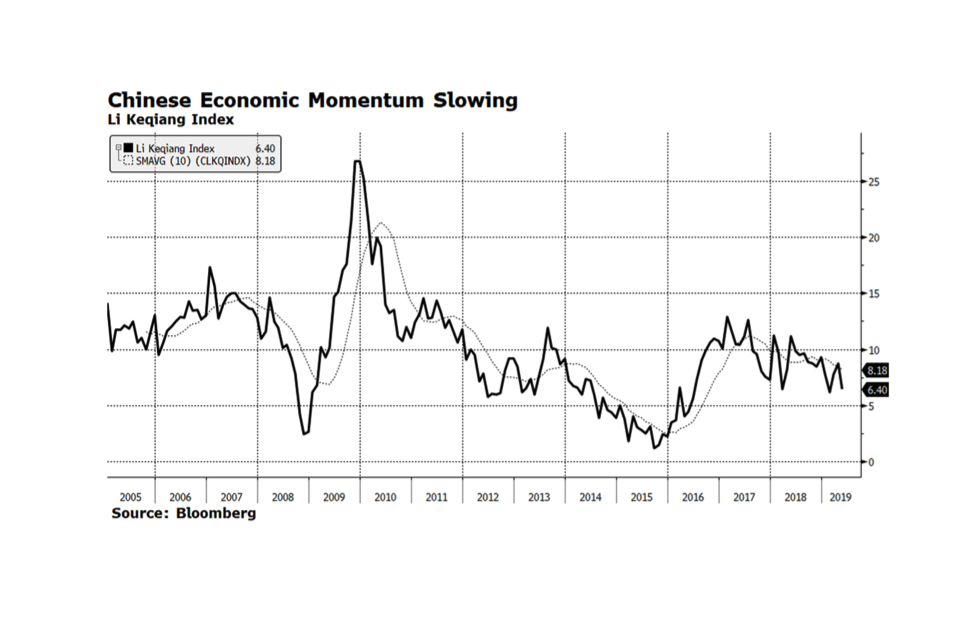

Welcome back from holiday. GDP growth in the Middle Kingdom has been slowing over the past several years and, as the world’s second largest economy, it has a significant influence on global capital markets. Our concern is that, while recent fiscal and monetary stimulus may have had initial positive effects, the impact may not be sustainable longer term. The country needs robust economic growth in order to support job growth and placate social unrest. Stronger growth would also help avoid a potential debt crisis as the pace of bankruptcies is accelerating – one indication that growth may not be as strong as it appears.

The official government figures for GDP growth – which we view with some doubt – stands at 6.4%, a level consistent with the Bloomberg Li Keqiang Index. The index itself has its limitations but measures the growth in bank lending, freight shipments and electricity consumption. It tends to over and undershoot the official figures and may provide a more realistic view on economic conditions in China. This indicator nonetheless bears monitoring as we await the June reading that will be out in days. [Chart courtesy Bloomberg LP (c)2019]