We have been looking at the charts, very much the heart of our process, and are a bit puzzled by Europe. Many of the fundamentals that we have discussed in our blogs, monthly and portfolio updates have been pointing to favorable market conditions for equities and a lid on rates thanks to ECB policy. But the charts – oh the charts. If we take currency out of the equation the market’s performance has been, to be kind, lackluster. Our question – what is holding it back?

Author: Mark Sloss (Page 7 of 10)

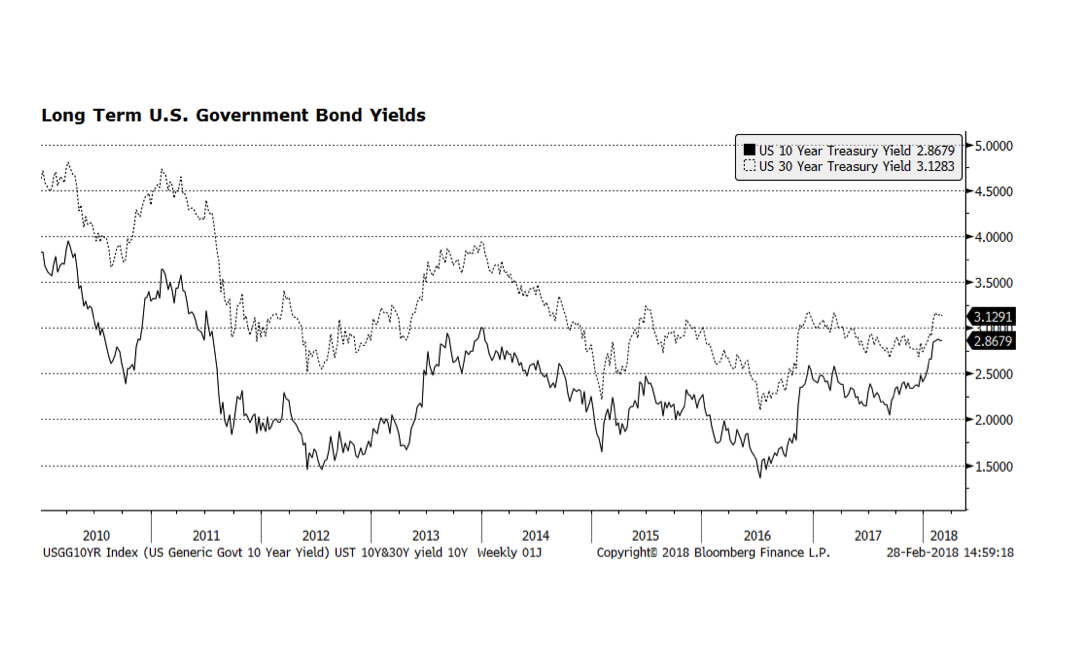

Stock markets around the world have been gyrating in response to higher interest rates – particularly in the United States. Long-term US Government bond yields have increased significantly over the course of the past year and a half. Yields on the 10 and 30 year US Treasuries have recently reached levels that some market participants believe may become headwinds for equities. While recent advances have been steep, interest rates are still well below what would be considered “normal levels” which would imply more volatility in corporate securities markets across the globe.

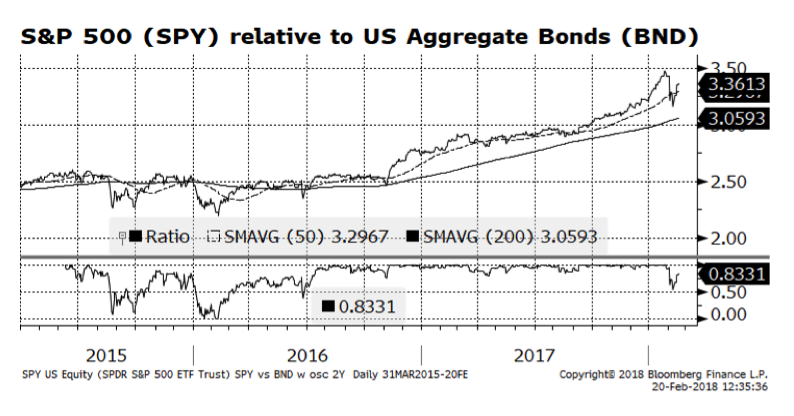

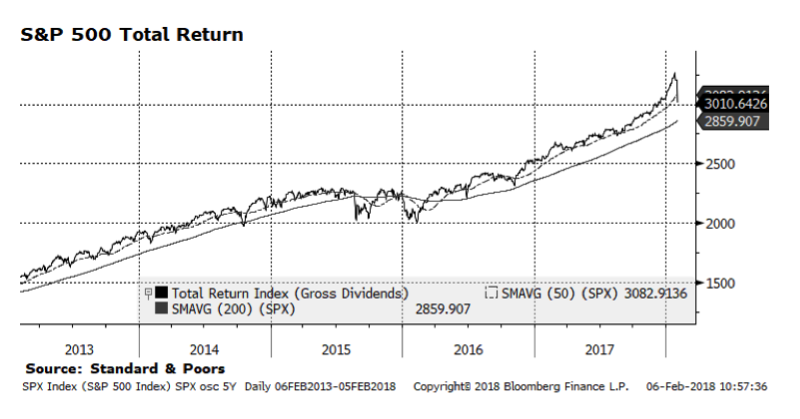

US stocks have regained their footing relative to US fixed income and have resumed their capital market leadership. Stock prices in the US have rebounded from their February 8th low while upward trending interest rates have been an obvious headwind for bonds. The higher interest rate environment, while widely anticipated by some for several years, may be a formidable challenge for equities both here and abroad. In our view, as long as interest rates rise at a moderate pace, equities should continue to advance and the global economic expansion should remain intact.

We would point out, however, that we are in the early stages of the recovery and the market may yet shake investors’ confidence in coming sessions.

Don’t forget to follow us on Instagram, Facebook and LinkedIn to get the COTW in your social media feed.

Don’t forget to follow us on Instagram, Facebook and LinkedIn to get the COTW in your social media feed.

We decided to sit this one out. The way the market just whipped around over the last few weeks with little provocation, our concern was about informationless volatility, and we did not want to jump into the fray with comments much less action without any additional insight. In our view, there was very little if any new information that came into the market to trigger the bout of vol. A lot of observers and pundits were pointing to data about jobs (or was it wage growth, or perhaps it was GDP?) that signaled the potential for inflation, and with it the specter of a Fed getting the knives out to cut back the easy money. But, at least from our perch, these new data points were not only knowable, they were known, and they were not new. Perhaps rate watchers and equity market participants were hoping if they clenched their eyes very tightly the hallmarks of an expanding economy might go away on their own.

In terms of purchasing power, there has not been real wage growth for at least a couple decades for the cherished middle class, much less their undercompensated neighbors further down the economic ladder. Even at sub-5% unemployment, the quality of jobs may be poor in terms of wages and ability to exploit workers’ educations, skills and capabilities, and many of those workers would take more hours if only they were available. Compounding that, a significant and growing portion of the workforce is self-employed, and not by choice. Many jobs that used to be salaried and permanent, including knowledge economy jobs that were supposed to be the future of employment, have become temporary 1099 gigs if they have not been shipped overseas entirely. When looking at the fundamental reality on the ground, we could not find a rational explanation for why markets choked on encouraging but fairly benign data. An overheating economy appears still far off in the future and the Fed’s path to higher rates is inexorable, yes, but also slow and deliberate.

So what happened?

The last few trading sessions in stock markets around the globe have been painful. The sell-off on Friday February 2nd was the steepest in nearly two years, only to be followed by a deeper fall Monday. The prompt for the market rout appears to be a strong jobs report in the US that included signs of increasing wage inflation. Benchmark interest rates, in turn, rose with the yield on the 10-year U.S. treasury climbing to 2.84% on Friday only to fall to 2.7% on Monday evening. The perception that interest rates may rise faster than the market expects unnerved equity investors. In our view, the US stock market is consolidating strong gains posted over the past year and its longer term trends are still upward-sloping. With economic conditions showing continued improvement and corporate earnings accelerating, equities should resume their upward trajectory after this bout of selling pressure recedes. For now, we view the stock market as experiencing a healthy, albeit harrowing, correction.

On Dr. Martin Luther King, Jr. Day, it is a good time to listen rather than speak. Here are a few places to go to hear about both the legacy and the present day state of social and economic justice in the United States:

On Dr. Martin Luther King, Jr. Day, it is a good time to listen rather than speak. Here are a few places to go to hear about both the legacy and the present day state of social and economic justice in the United States:

Equal Justice Initiative – https://eji.org

Southern Poverty Law Center – https://www.splcenter.org

The Innocence Project – https://www.innocenceproject.org

And, a compendium of discussions and excerpts from Dr. King’s sermons and speeches — https://www.npr.org/news/specials/march40th/speeches.html

And we’re back! Happy New Year to our friends, clients and partners.

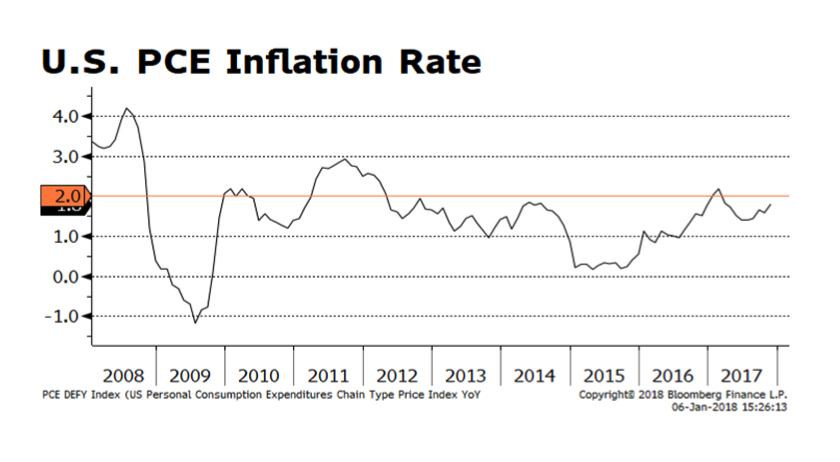

US Personal Consumption Expenditure (PCE) Prices, depicted in this week’s chart, is an inflation indicator that we follow closely. It is still below the US Federal Reserve’s 2% target, but getting closer. This has historically been among the favorite inflation indicators monitored by the Fed and Fed watchers. Our concern is that, if inflationary pressures prompt the new Fed leadership to adopt a more rapid approach to raising the Fed funds target rate, the yield curve could flatten further or even invert. Complicating this picture is that comparable longer-term yields in Europe and Japan will likely stay lower for longer due to central bank intervention. The result could continue to tether comparable US treasury yields and lead to a yield curve inversion in the US, which in the past has been a reliable precursor to recession. However, such an inversion caused by central bank intervention rather than from the natural course of the business cycle could produce unpredictable consequences. This relationship bears watching.

I saved this note until today as a thought experiment even though much of the news on the subject has unfolded over the last few weeks. Circulating at various friend-and-family events through the holiday season I wanted to take inventory of how often Bitcoin and crypto-currencies in general came up since I am usually the “investment guy” in the room. The questions have run along the line of “Should I be getting into this?”, “Am I missing an opportunity?”, and “Are you guys in Bitcoin?”.

Well, actually regifted from last week’s Facebook, Instagram and LinkedIn postings as a reminder to follow us on social media (link icons on the right of your screen).

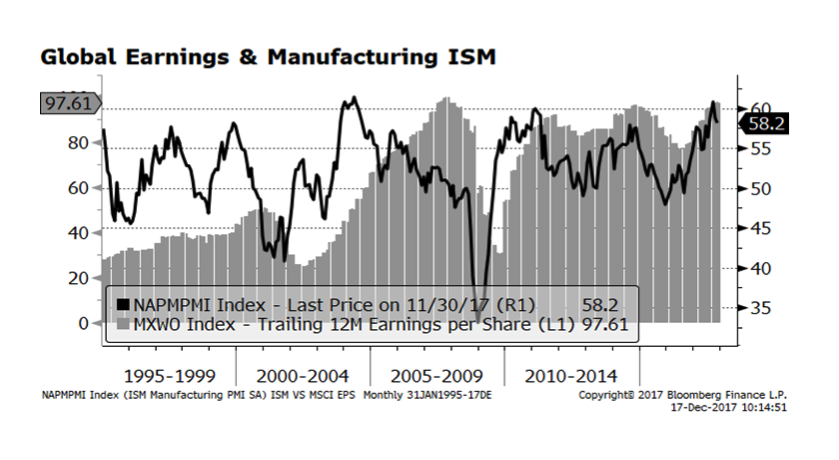

We highlighted this chart back in late October showing the relationship between the US Institute of Supply Management (ISM) Purchasing Managers Index and Global Corporate Earnings. One of the risks we were concerned about then was if tax reform stalled. That risk appears to be behind us as Congress is set to approve the somewhat controversial tax plan.

Several Wall Street investment firms, notably Goldman Sachs and Barclays, have recently increased their forecasts for global GDP growth to 4% based on improving manufacturing survey data and consumer spending trends. The positive impact on global earnings levels should continue to support global equity price levels even with many market valuation metrics full or in some cases stretched. Robust global economic activity is a welcome development but risks still remain including the path of interest rates in several of the G7 bond markets and geopolitical risks associated with the Korean Peninsula and elsewhere.

Democracy always feels better when standing on the winning side. PM Theresa May got a sense of that in the British snap election a couple months back. PM Angela Merkel is still struggling to assemble a coalition to govern since losing a controlling majority. In Catalonia, PM Rajoy dissolved the regional government, and members of the dissident leadership found themselves in jail or in exile as he called snap elections. That may have added fuel to the fire as Puigdemont and his cadre campaigned from Belgium, or even prison. A theory had been circulating since the separatist movement succeeded in their earlier referendum on independence that the victory, if even legitimate, was the consequence of a vocal and active minority of the electorate, and the majority of Catalans were with greater Spain. That was undoubtedly part of Rajoy’s calculus in calling the election — let the wheels of democracy turn and reassert the will of the true majority.

In thinking about our portfolios, we are not arguing about the merits of the movement. We are contemplating the implications for Spain and for Europe. The international community has come down on the side of Spanish unity, but in a modern Western democracy, the options are becoming increasingly limited when election after election states that a sizeable portion of the population wants an exit. We think it is unlikely that a program of sanctions or even military action would or could be pursued without creating destabilizing ripples in other regions of Spain and across Europe. If democracy, ugly and painful as it is, is to hold and free markets are to follow, we would anticipate Spanish and European concessions to give Catalonia just enough of what it seeks to make it more attractive to stay than to leave. We see strength in the broad European market and have a long-term view that the Euro will rise, but in the nearer term we could see instability and even retreat in both as concerns about the integrity of the currency come back to the fore and discontent in peripheral Europe puts a tarnish on the economic shine. Germans are having trouble leading the region while they cannot lead themselves, Britain is on its way out, isolationism and nativism are still on the rise, and Macron’s France does not have the economic and political muscle to maintain regional stability on its own. Absent strong, coherent regional leadership, we believe the path to confidence and stability does not begin or end in but certainly runs through Barcelona.