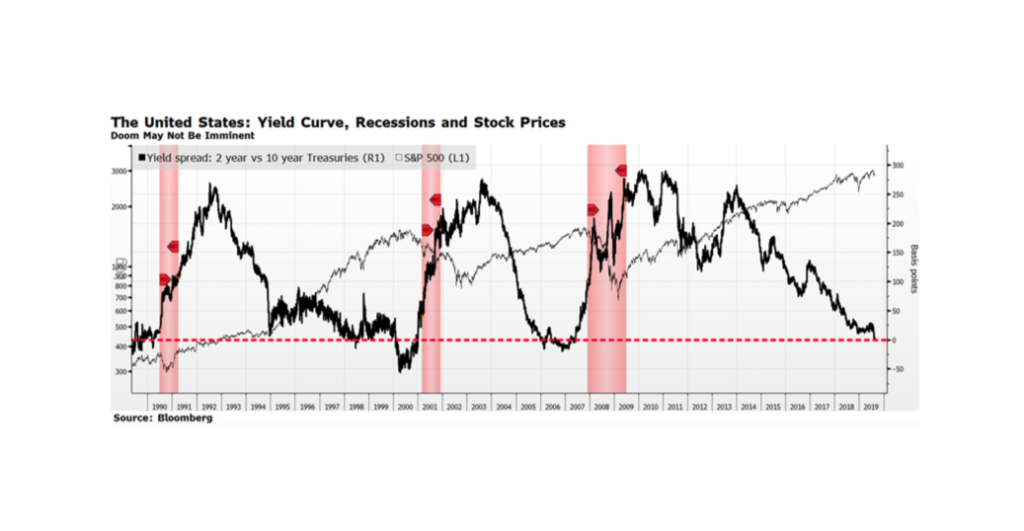

The US Yield Curve inverted this week for the first time since 2005 as the yield on the 10-year US Treasury fell below the 2-year. Stock markets around the world fell with the Dow Jones Industrials suffering its worst point drop of 2019 — over 800 points alone on August 14th. Investors are concerned because an inverted yield curve has preceded the three most recent recessions, highlighted in the shaded areas on this week’s chart. This time may be different because a case can be made that longer-term interest rates in the US are being suppressed due to negative interest rates in several developed countries, which is likely distorting the US yield curve. Another observation from the chart is that, while an inverted yield curve causes equity market volatility, it does not necessarily derail stock prices in the intermediate term. US equities continued to rise in the early and late nineties as well as from 2005-2007, all instances that occurred with curve inversions.