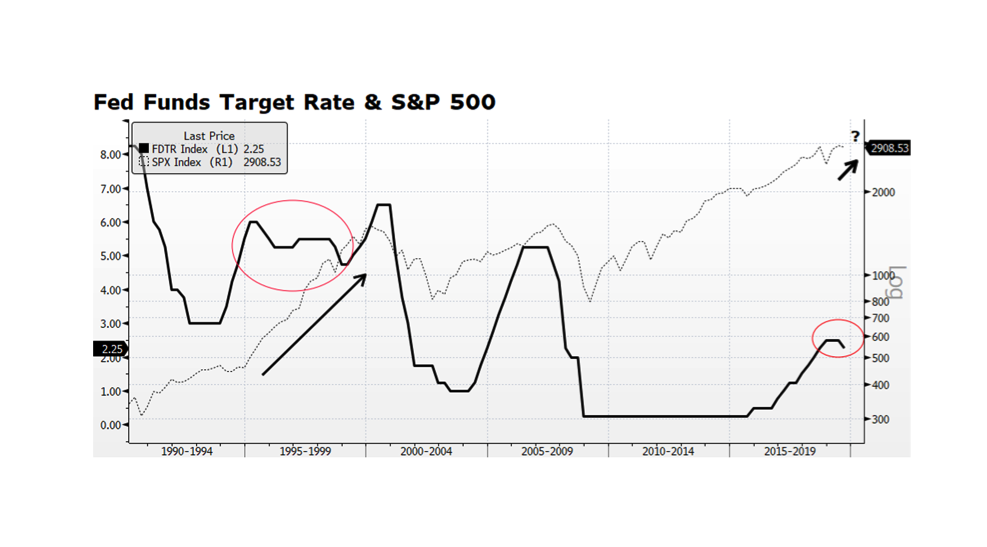

There has been little doubt in investors’ minds that monetary policy has played a critical role in supporting the global economy and capital markets for several decades. Lately, the focus has been on how many times (and for how long) the US Federal Reserve will cut its Target Rate this cycle. The current US economic expansion is the longest on record, and the question is whether late cycle rate cuts can sustain growth and the upward trajectory in the US stock market. The most recent prior period we had a mid-to-late cycle reduction in the Fed Funds Target Rate was during the Alan Greenspan era when easy monetary policy fueled the Technology-driven bull market during the 1990s. In the aftermath of the Tech bubble bursting, Greenspan was criticized for being too accommodative and ultimately producing a deeper rout than otherwise could have been. Many forget that the rationale for easy monetary policy at the time was in part a response to the Asian currency crisis that spread from Thailand throughout South East Asia in 1997. The current US Fed actions are a response to global economic weakness and should ultimately provide support for stock markets around the world. A critical difference this time around is that fundamentals and valuations in the US stock market are far stronger than we experienced during the late 1990s. [chart courtesy Bloomberg LP (c) 2019]