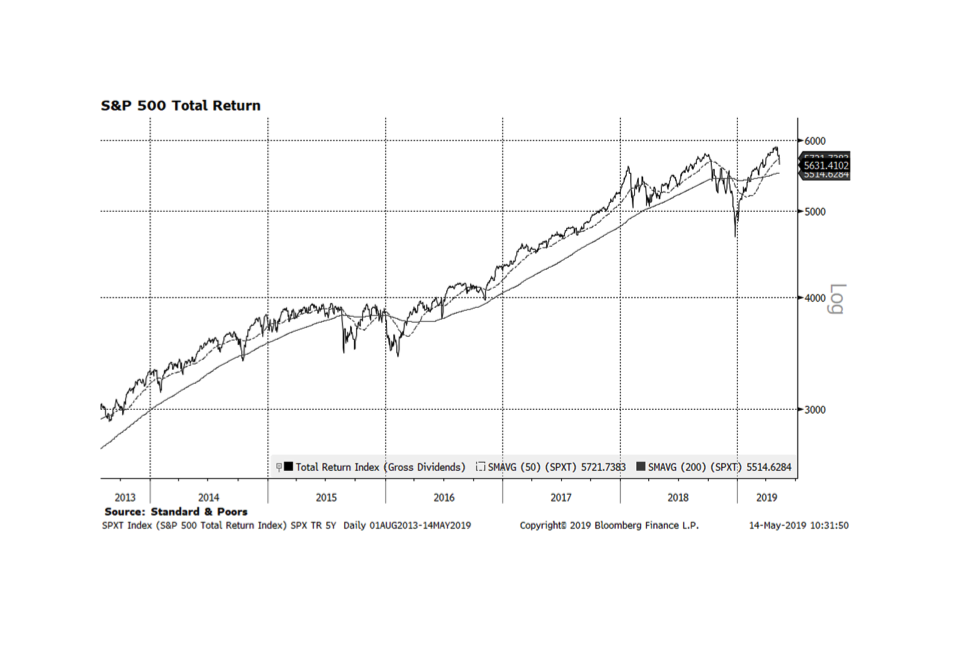

US stock markets have continued to be roiled by ongoing US-China trade negotiations. Departing Washington DC last Friday, Beijing issued a strong statement challenging US demands for fairer trade. The core issue for the Chinese is that the US is forcing the Chinese to change their laws regarding intellectual property protection, dispute resolution enforcement, and mandatory joint ventures, among other issues. That is seen as an affront to Chinese sovereignty. Beijing needs to “save face”, avoiding being seen as a weakened nation from a domestic perspective and just as importantly throughout the region. To form a trade agreement with the US, China’s lead negotiator Liu He will have to concede on these points which will then form the template for other major trading partners such as Europe to follow. Beijing probably realizes that, by giving ground to the US now, it is only a matter of time before their decades-long trading advantages evaporate. While this major global event plays out, we expect more volatility and would not be surprised to see US stocks test or even trade through their long-term trends as depicted by this week’s S&P 500 Total Return chart.