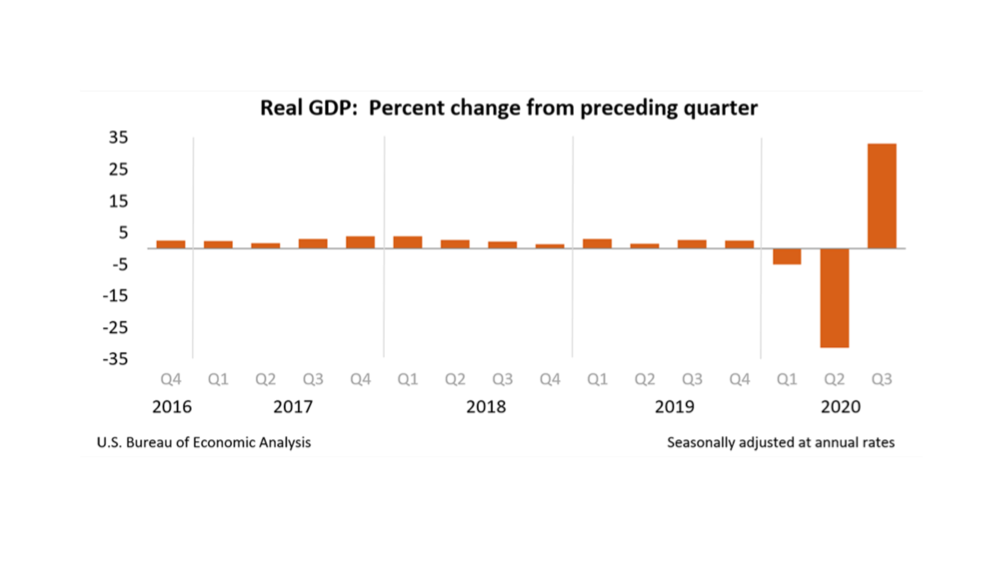

As many expected, the US economy rebounded strongly in the third quarter exceeding economists’ forecasts. The BEA reported GDP grew at a 33.1% annualized rate while the consensus estimates stood at 32.0% prior to the announcement. The rebound is quite welcomed in the wake of Q1 and Q2 contractions of 5.0% and 31.4% respectively. Strength was delivered across nearly all key sectors of the economy with the exception of Government Spending. Personal Consumption Expenditures, the largest segment of the economy, grew 40.7% (annualized) in Q3, highlighted by an 82.2% advance in Durable Goods. Gross Domestic Private Investment expanded at an 83% clip. Exports and Imports also rebounded impressively. The recovery appears to be underway and the recent report is headline grabbing, but the level of GDP is still some 2.8% lower than at this point last year. The key to the trajectory going forward is in state and local lock downs which are lifted or reinstituted as confirmed COVID-19 cases are peaking across the nation. This introduces major uncertainty which, along with the lack of additional stimulus spending, have caused capital markets to become more volatile over the past several trading days. Stay tuned. We will.