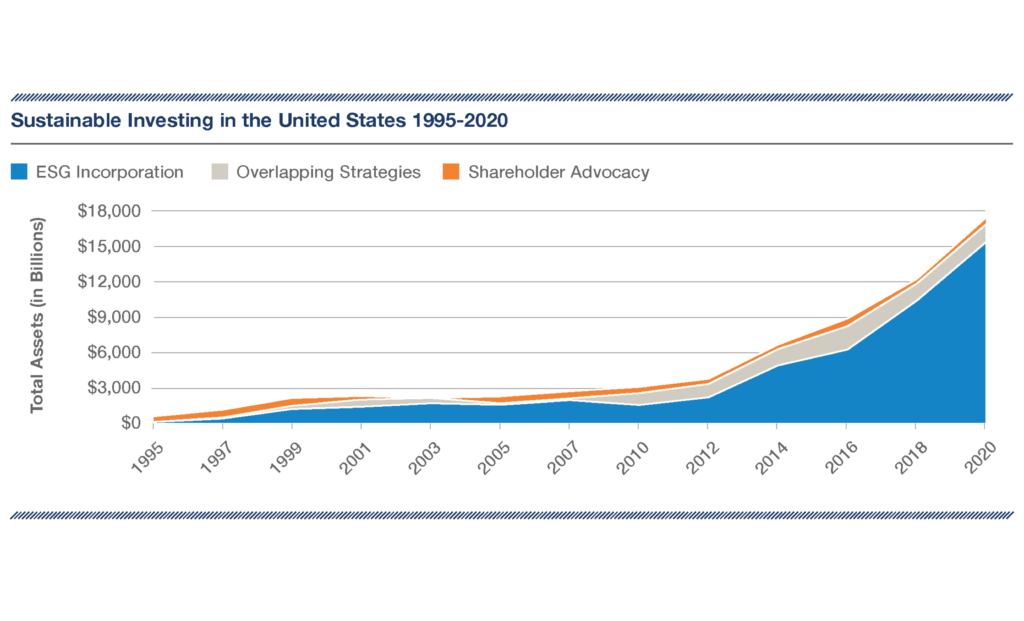

The idea of investing in a way that is consistent with your values is continuing to gain traction, maybe even more so through the pandemic. Beyond values, there is also an understanding that investing in a way that is socially, environmentally and ethically aligned also delivers market-like (or potentially even better than market) financial results. According to the US SIF Foundation’s 2020 Trends Report from which this week’s chart is taken, more than $17 trillion of the $51.4 trillion in professionally managed assets in the US as of year-end 2019 were aligned with the principles of ESG investing. Even deeply discounting that figure leaves an enormous quantity of assets and a steep growth curve. Investors who do not cleave to ESG or related disciplines still must take note of a market move of this magnitude. Stakeholders have spoken and ESG is part of the mainstream market conversation.