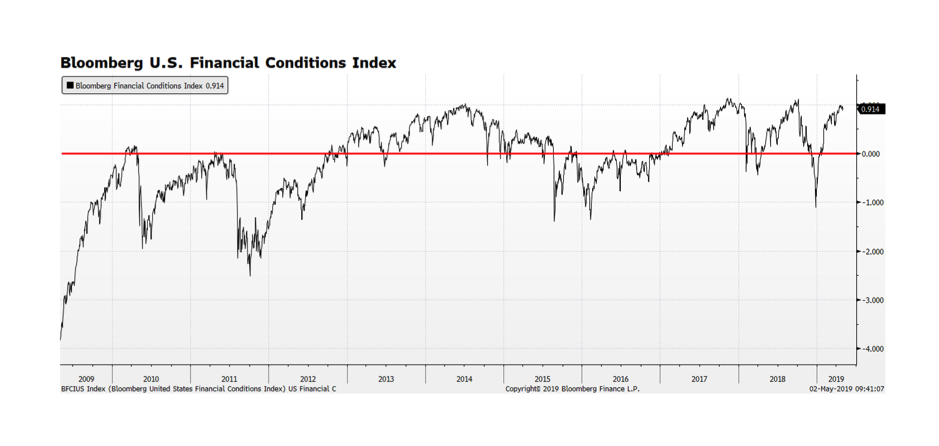

Bloomberg maintains a series of global and regional financial conditions indices that combine several key fixed income and equity market metrics such as interest rate spreads and volatility. Taken together, this data gives an indication of how benign or strained conditions are in the capital markets. Currently, the reading in the US is positive, indicating a benign environment for risk asset classes. It is important to recognize this indicator can maintain long periods of positive or negative readings but when it begins to move in a downward direction capital markets become stressed. US financial conditions could continue to remain in a positive state due to favorable economic trends — low inflation, accommodative monetary policy, strong productivity gains, high labor participation and robust GDP growth.