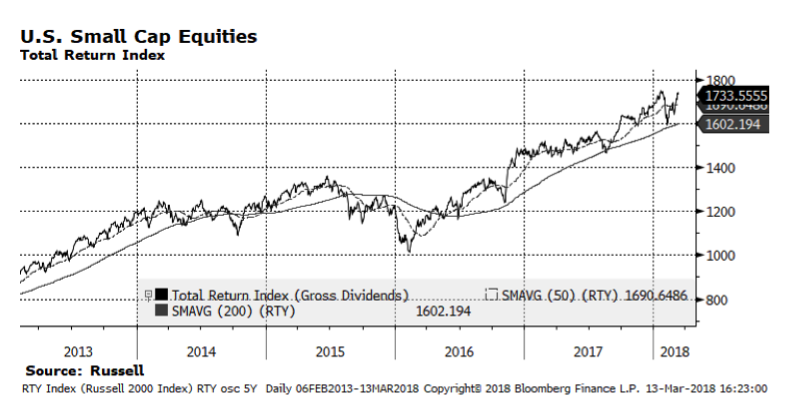

Every cycle is a bit unique, but usually small- and mid-size companies underperform in the late stages of market cycles and ultimately contract more than their large-cap counterparts as markets correct. There is much concern that this cycle is in an advanced state and a consolidation or correction phase is upon us. What we find interesting is that small cap US stocks are rebounding and approaching all-time highs. We view this as an important development if the trend continues, especially with the heightened volatility of late. We also note that it appears that small- and mid-cap stocks have contracted less over the past week or so than large-caps on days when the major indices are negative. If these key segments of the stock market can surpass levels reached earlier in the year, that would mark obvious positive milestones and could lead the overall market higher still. Fundamentals dominate our analysis, but these technical factors are worthy of our attention as well.

© 2024 Wilde Capital Management

Theme by Anders Noren — Up ↑