We have been intrigued over the past several months by total return trends in US bond markets. It has been a rough first half of the year for bonds so far with the Bloomberg Barclays US Aggregate Total Return index contracting 1.95% year-to-date through June 22, 2018. What is interesting to us is prices have fallen to a greater degree in US investment grade corporate bonds as measured by the iBoxx Very Liquid index, (-4.78%) as compared to with the Bloomberg Barclays US Treasury Index (-1.43%). This has occurred while US corporate fundamentals are quite strong.

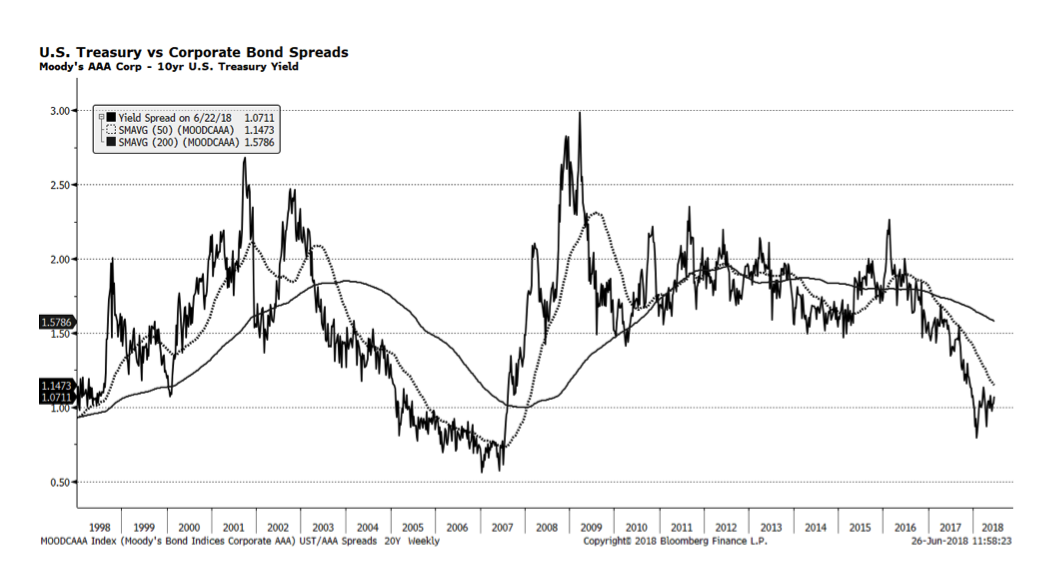

What concerns us is that interest rate spreads (depicted in the chart) between US investment grade corporate credit and US Treasuries have climbed from levels we last experienced during the pre-crisis era. This could just be a pause and spreads resume their tightening path that began several years ago, ultimately approaching lows reached in 2007. Or we could see further widening that could signal economic and market deterioration. There are many dynamics at play – central bank activity across the globe is a major factor – and this is one simple measure, yet we believe it is a critical one.