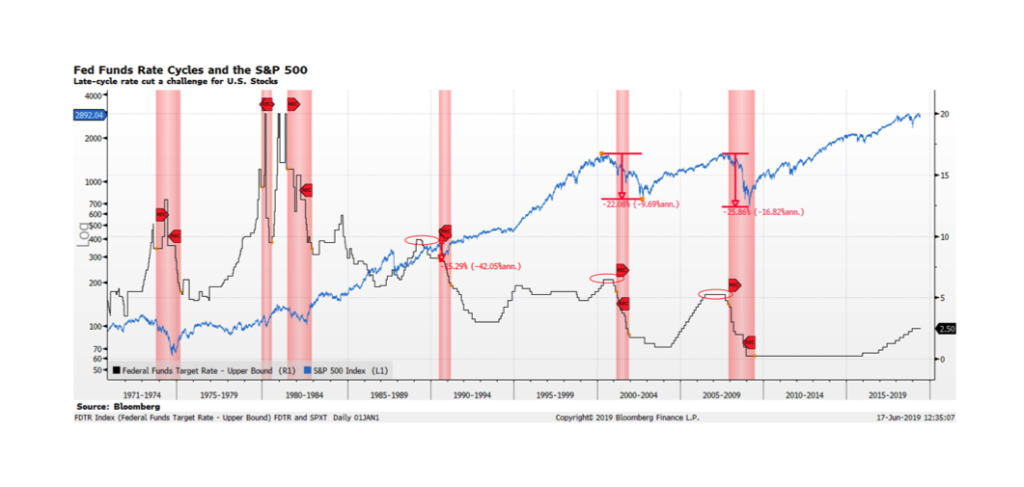

With many investors pining for the US Federal Reserve to begin lowering the Fed funds rate at the conclusion of its’ policy meeting today, the aftermath of late cycle rate declines can serve as an ominous reality check. Few question that the US economy’s advance is in its latter stages with the current expansion lasting over a decade. Yet lower policy rates may not be a panacea. The past three recessions have been preceded by late cycle rate declines orchestrated by the Fed. US equities have not fared well during those lower rate regimes collapsing 15.3% in 1990, 22.1% in 2000-02 and 25.9% 2007-09. The key for investors is if the Fed can re-kindle activity in areas of the economy that have weakened lately, avoiding recession and an adverse reaction in the stock market. Another factor is Fed credibility give its policy U-turn to this year’s more dovish stance after hawkish comments made towards the end of 2018. This cycle could be different. We could see modest downward rate adjustments like we experienced in the mid-to-late 1990s which helped fuel the Tech-driven bull market.