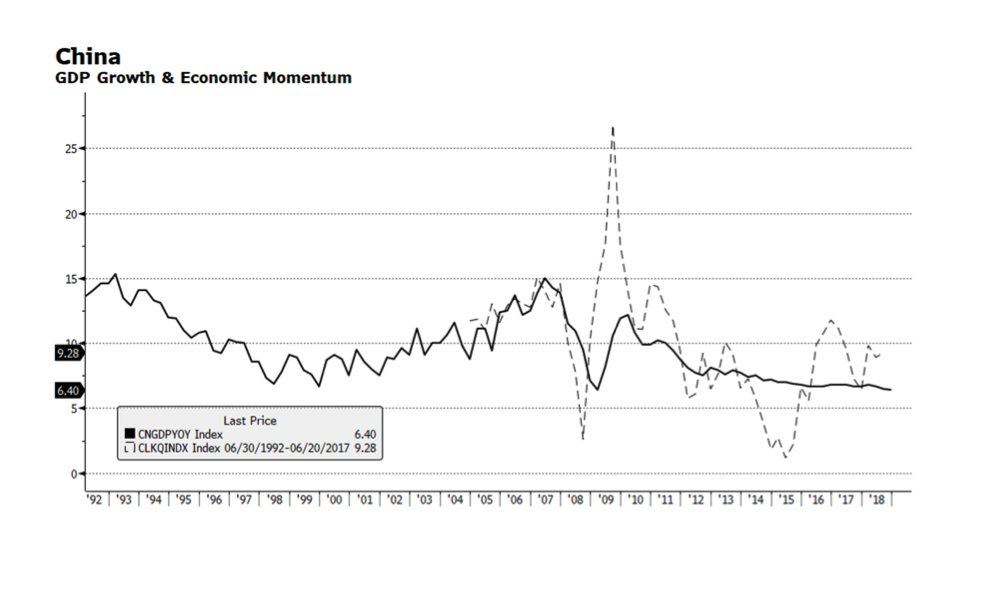

Markets have responded negatively to Monday’s release of a fourth quarter GDP growth rate of 6.4% by the Chinese government. The reality is that growth in China has been moderating since the Great Recession, which should not be unexpected since China is now the world’s second largest economy next to the US. What has compounded matters is that the rest of the developed world, particularly the Eurozone, the UK and the US, also is showing signs of moderating economic activity.

There is also considerable speculation that the actual growth rate is lower than official government figures suggest. The chart below depicts the official Chinese government figures and the Li Keqiang Index, an economic proxy index calculated by Bloomberg Economics, which combines growth rates in outstanding bank loans, electricity production, and rail freight volume. The latter index is regarded by some as more timely as well as more accurate, and that may be true, but both indices are trending downward. It is important to note that the Li Keqiang measure is in nominal terms and after adjusting for inflation, currently expected to be approximately 1.9%, in line with or even below the official GDP release. Both indices are decelerating and it remains a viable consideration that economic growth could be even lower.