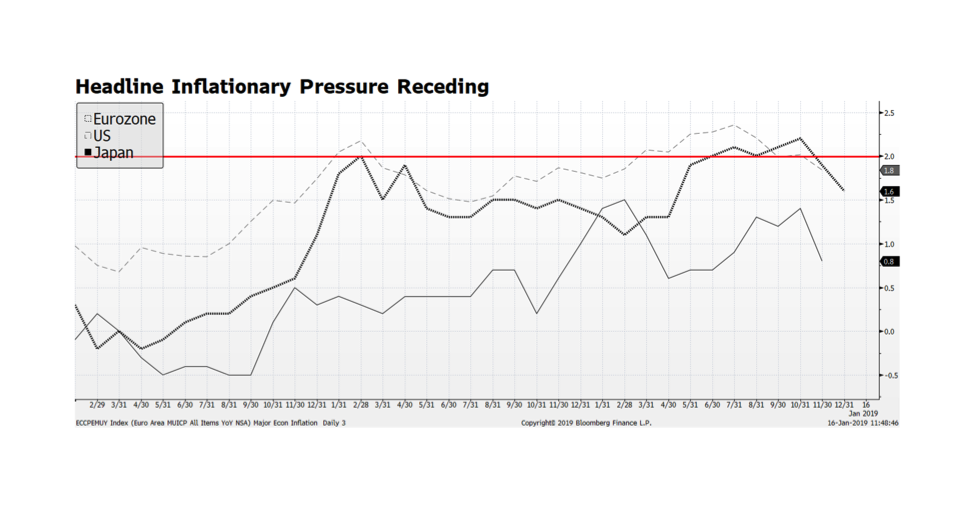

Benign Inflationary Measures Give Central Banks Room to Maneuver

Global stock and credit markets have begun to regain lost ground after dovish comments from US Federal Reserve Chairman Powell and his predecessors Janet Yellen and Ben Bernanke. Powell remarked that inflationary pressures are not evident and market participants interpreted that as a sign of less urgency for the Fed to continue to raise policy rates. Inflationary readings are also declining in the Eurozone and Japan, bringing inflation in all three key regions below their stated 2.0% target (the red line on the chart). With the prospect of imminent and continued interest rate hikes pushed further out in the year if at all, the environment for risk assets should remain supportive. Yet, how the current US Government shut down, now the longest in history, unfolds remains a major concern.