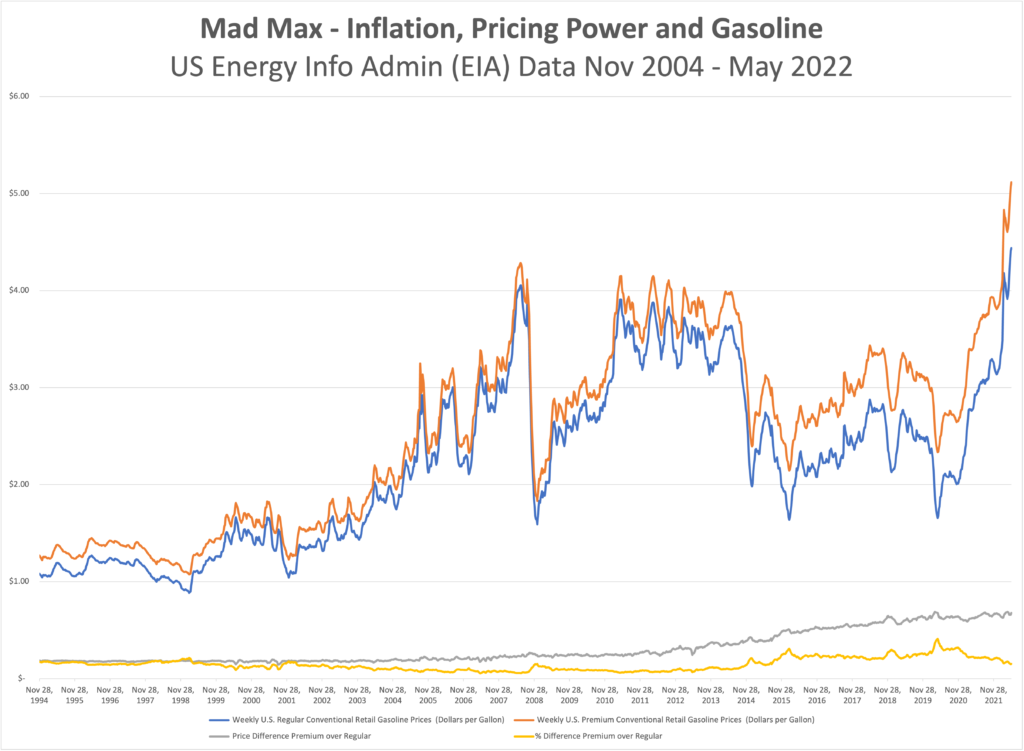

What’s up with gas? Inflation is everywhere, but it is hard to normalize when we are having the breakfast table conversations about how much prices have climbed. Our shopping carts are different from each other’s and aren’t always consistent from one trip to the next, but we get a general sense that the final tally is higher but the receipt isn’t any longer. One thing most of us, with the exception of certain urban dwellers and the small population of EV drivers, do have in common though is the price of gas. There is some geographic dispersion because of cost of delivery and local/state taxes, but we all buy the same three or four grades of gasoline, measure it in gallons, pay for it in dollars, and unless we change vehicles from one fill to the next, consume it at roughly the same rate per mile driven. This chart won’t reveal the mysteries of why prices are up, but there are a few interesting takeaways that show that there aren’t likely any easy answers. Maybe the most notable observation is that gasoline has gotten more expensive than the prior all-time peak in 2008 (about 11% higher right now). What isn’t on the graph is that oil (WTI Cushing) is about 21% cheaper than it was during the ’08 bubble.

Back to the chart, we can see that the spread between premium and regular gas has been steadily grinding higher for years, with few interruptions in the relationship outside of brief reactions to the Tech Bubble, 9/11, the Financial Crisis, etc. For those old enough to remember, it was bankable that mid-grade was 10 cents more than regular, and premium was ten cents more than that. Now that premium/regular spread hovers between 65 and 70 cents, today and two years ago when everyone was hunkered down at home. These figures would indicate that the petro industry still enjoys tremendous pricing power. When thinking about inflation it is important to consider what the drivers are and who gets hurt, but also who benefits. It was almost exactly 11 years ago when WTI was the same price it is today ($112/bbl). Regular was $3.91, and Premium was $4.15. Today at $112/bbl, Regular is $4.44 and Premium $5.12. [chart © WCM 2022, national data from US Energy Information Administration (EIA)]