We didn’t vaporize in a white hot nuclear flash, and the tone of the Singapore talks was cordial and concluded with few decisive next steps but at least a commitment to detente. We are looking for the market story in all this, and often like to look beyond the four walls of WCM for insight from other market participants. Here is a link to some insightful commentary on Korea from Michael Oh of Matthews Asia, a boutique we currently use in our ESG portfolios for emerging Asia exposure.

Category: General (Page 10 of 17)

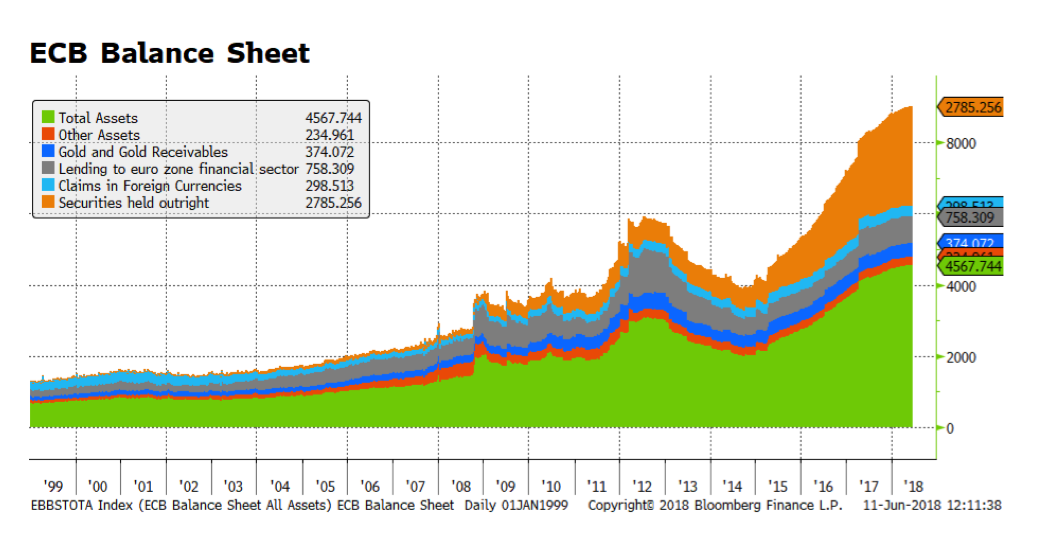

Ooooh. Color! This week’s focus is on major central bank activity with the European Central Bank (ECB), the US Federal Reserve and the Bank of Japan (BoJ) all scheduled to make policy announcements at the conclusion of their respective meetings. Beginning Wednesday with the US Fed, market observers are widely expecting a further 0.25% increase in the Federal funds rate but the focus will be on which words are selected and projections going forward. The ECB follows on Thursday and the key to their statement will be any adjustments they intend to make regarding the bond buying program and the impact on the balance sheet, pictured below. The BoJ closes out the week on Friday and market participants are largely expecting no change to current policy given inflation is below target and the tightening labor market does not appear to be adversely impacting prices.

And here we find ourselves on the cusp of… something. Only Trump (ok, maybe Dennis Rodman too) could go to North Korea or at least meet with them in Singapore. Conflict has continued on the Korean peninsula and with the Japanese for a century, and was codified on the map as a contest between two political philosophies at the 38th parallel in the closing days of WWII. Even though we have maintained a military presence in Korea post-armistice, and of course have troop exposure elsewhere in the Pacific theater, it is only in the last few years that they have become a true direct threat to the US. Whether it is the dubious reach of their ICBMs, or simply the potential leak of fissile material and weapons technology to other state- and non-state actors, they have achieved their objective of becoming players of global consequence.

The latest Talchum has unfolded like a WWE match between Little Rocket Man and the Dotard with grandstanding, trash-talking, outright threats, cancellations and reinstatements. What do we make of it as investors? Good theater but not much real-world consequence. Of course nuking Seoul or Tokyo would devastate Asian and global markets, but that was an improbable outcome especially while Trump waved his hand over his “much bigger and more powerful” (nuclear) button. Kim’s regime needs food, energy, technology, medicine, general economic vitality and some degree of acknowledgement and respect on the global stage, none of which would be achieved under a mushroom cloud.

If Trump and Kim part company having not advanced anything, we have the status quo and both leaders can return to their countries claiming they got the other to the table. The market continues along as it did yesterday, last week and last month with no new information. If they come to some accord, geopolitically there is a great deal of relief and we can back up the Armageddon clock a couple seconds, but little changes economically. NoKo coming into the international trading community does not have the same consequence as Iran with their oil and cash wealth. An open North Korea might in the fullness of time become a venue for producing nations to trade and in decades could be a candidate for a German-style reunification, but in the immediate future they are at best aid recipients.

If the talks degenerate into name calling, chair throwing, and fallaway moonsault slams which, if the White House can pick a fight with Canada at the G-7, could happen, we will update this blog from the basement. Absent that outcome, we remain committed to Asia, particularly developing Asia, and see a status quo for the market.

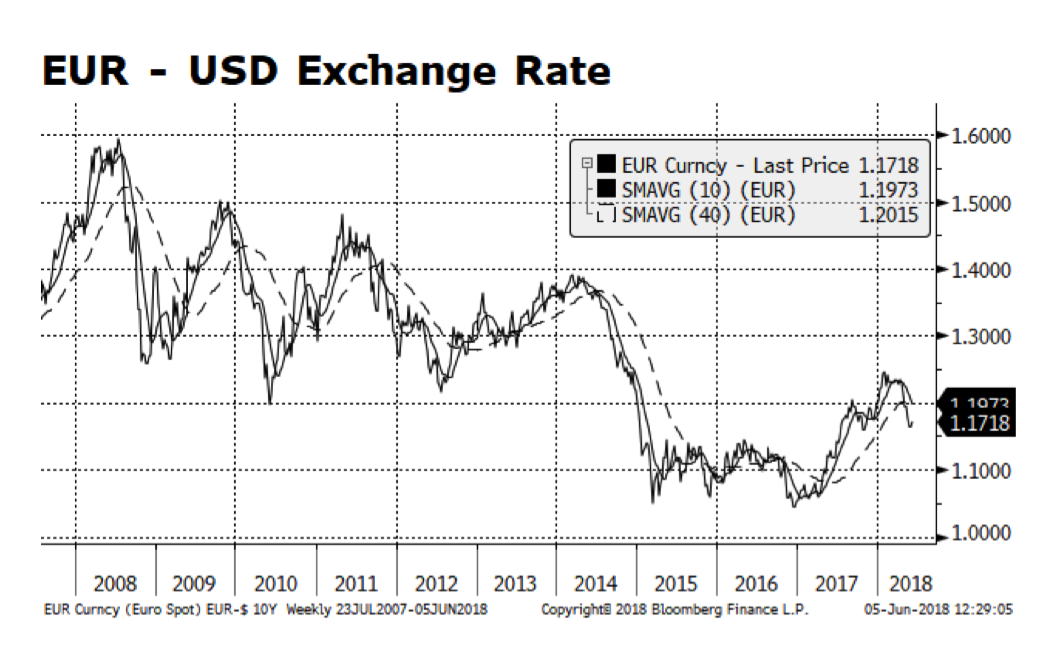

We’re back to charts after a holiday week hiatus, but Italy didn’t take a break. Another Euro-related crisis may be lurking in Italy as the populist coalition government, consisting of the Five Star Movement and the far-right League parties, have formed an administration. Although the parties have dropped some of their most alarming campaign rhetoric concerning exiting the Euro and EU, investors have re-focused on Italy’s sovereign debt levels now surpassing 130% of GDP (well beyond EU budget rules) and the limitations it imposes on fiscal flexibility.

Not surprisingly, the Euro has weakened considerably — particularly against the US Dollar. The cause of the softening Euro likely spans beyond Italy’s contribution of 15% EU GDP. Several key Eurozone economic indicators such as industrial production, business sentiment and consumer confidence appear to be losing momentum.

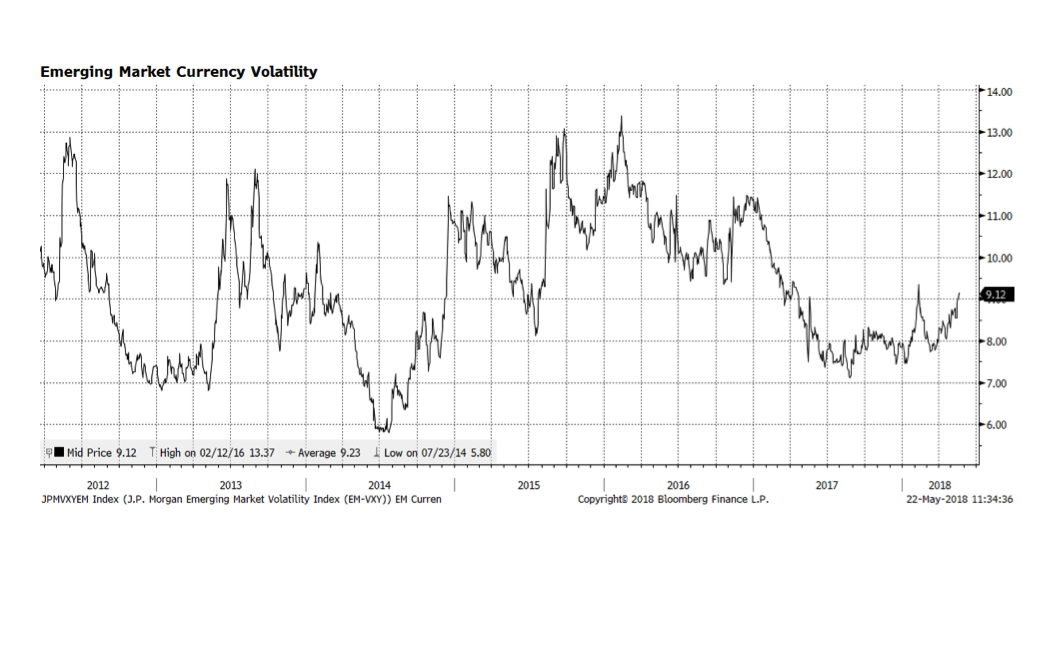

Several currencies in developing economies have been weakening against the US dollar and not surprisingly, volatility, depicted on the chart below, has been rising. Part of the fallout is related to US dollar strength against the Euro, Japanese Yen and British Pound but rising interest rates in the US are also a significant influence. External dollar-denominated debt issued by emerging economies in recent years has risen and repayment could be challenging if the dollar continues to strengthen. This warrants monitoring. We continue to have no emerging market debt exposure at this time.

The yield on the widely followed benchmark 10 Year US Treasury bond eclipsed 3.05% Tuesday morning May 15th and now stands at levels last seen in 2011. The rise in April’s retail sales report showing further expansion likely helped push rates higher. Stronger economic activity and the potential for inflation are forces potentially putting upward pressure on interest rates, but record Treasury bond issuance is also a highly influential factor in the other direction.

We believe interest rates will continue to rise as the US Federal Reserve pursues monetary policy normalization and the economy expands. As a result, our fixed income positions remain short duration. Bloomberg’s survey of 58 analysts projects the yield on the 10 Year US Treasury bond should reach 3.19% by the end of 2018 which would imply further price declines in longer duration fixed income.

Following through on a campaign commitment, President Trump announced that he is withdrawing the United States from the multilateral accord that halted Iran’s nuclear program development and opened it to international verification in exchange for the lifting of economic sanctions. We will leave the analysis and commentary on the reasoning as well as the implications for regional stability to others. Our specific concern is what the implications for global public markets might be.

The most obvious place market participants are looking for a signal is in the oil market. Our view is that there will be little direct impact on the global supply-demand equation since consumption patterns are unlikely to change and most of the world can still access Iran’s output.

Where we think there is underappreciated and largely unmeasured risk is in the asymmetrical application of a sanctions regime in global fixed income and equities. Continue reading

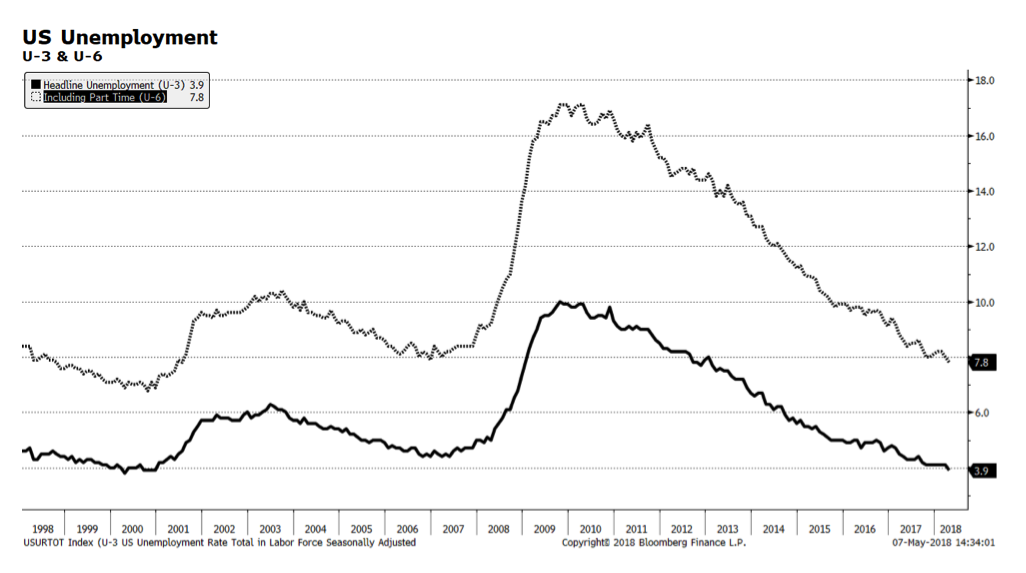

Last week’s unemployment figures released by the US Bureau of Labor Statistics were further signs that the labor market as well as the overall economy continue to improve. Headline unemployment is at the lowest level since the technology boom fueled 1999-2000 period. Unemployment including part time workers is approaching levels experienced during that same timeframe. While this is good news for the American worker, the market is concerned that labor scarcity could place upward pressure on wages, inflation and ultimately interest rates. Right now, nominal wage inflation is contained at 2.6%, a level the Federal Reserve has indicated to be tolerable.

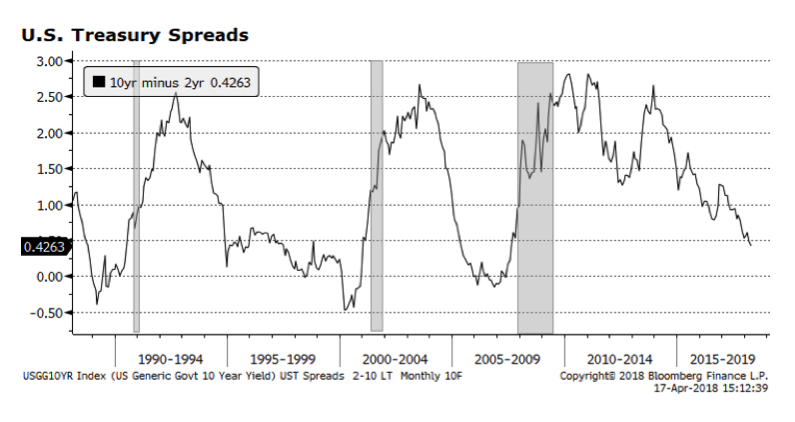

John Williams, current head of the Federal Reserve’s San Francisco branch, will soon be taking over as head of the influential New York branch. He was recently discussing a range of topics including the flattening of the US yield curve, which measures the spread between shorter and longer-term US Treasury rates. The risk is that as the yield curve inverts – when short term rates rise above long term rates – a recession usually follows (represented as shaded areas spanning back three decades).

It appears that we may have some time before the curve inverts, if it does at all. Every cycle is different and this one is unique due to the absolute low level of rates throughout the world. Interest rates in Europe and Japan may anchor US rates lower than they otherwise would be. That, in turn, may distort the shape of the curve in coming quarters and with it change the economic impact.

Investors have been focused on gyrations in the US equity market and rightfully so. It has been quite harrowing to witness the large intraday price swings in the major US indexes as market participants react or sometimes overreact to tariff and trade-related posturing among the Trump administration and trading partners. Our sense is that the market is attempting to establish a new equilibrium once a new global export/import balance is established. A new global balance of trade may not be bad for the world as long as the outcome is truly fairer and freer trade, but still, the uncertainty around this issue has caused painful volatility.

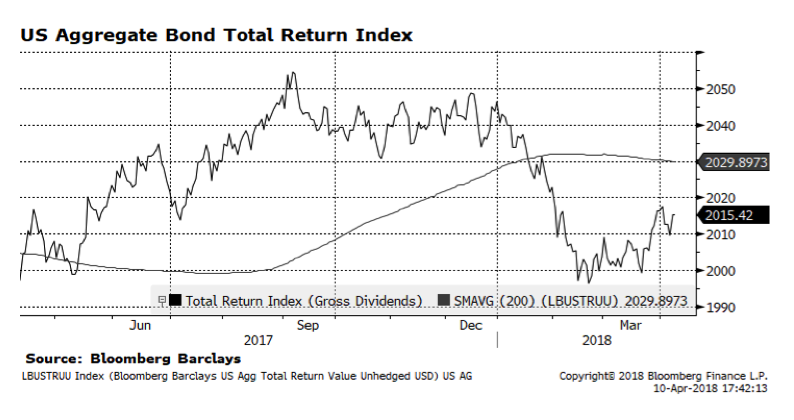

Meanwhile, the US bond market as measured by the Bloomberg Barclays US Aggregate Index depicted below, has offered a relative safe haven at least since mid-February. However, the index is about 1.5% lower year-to-date. We are concerned about rising interest rates in the US and the impact on bond prices and potentially the stock market. In the bond portion of our portfolios we have allocated to investments that are shorter duration and tend to perform better in rising interest rate environments. On the equity side of the equation we have more exposure to less rate sensitive sectors. We view the interest rate environment as a major risk and we believe that the US Federal Reserve will continue to be highly transparent and deliberate as it raises policy rates. Another anchor to interest rates in the US is accommodative central bank policy in the Eurozone and Japan where comparable interest rates are expected to remain low for longer.