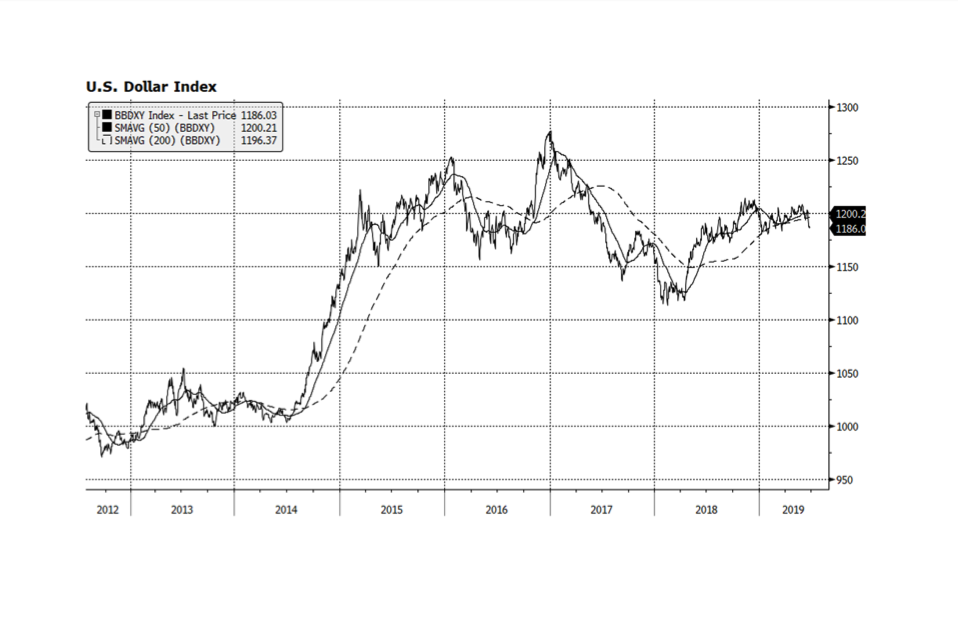

The dollar has weakened considerably over the course of the past few weeks after having strengthened for much of the year. It has fallen below its long term trend (the 200-day moving average) which in the past has led to further weakness. The decline in US interest rates and expectations for further reductions in policy rates by the Fed are likely behind the dollar’s fall yet it is difficult to make the case for the dollar’s value to decline further against major currencies. Economic activity in the US is stronger than all other major economies (with the exception of China, which is slowing) and the yield on the 10-year US Treasury is positive while comparable rates in much of the developed world are negative. Currency movements are notoriously challenging to predict, but the dollar could decline more despite US economic strength as the other major currency values normalize to levels seen earlier in the decade. [chart courtesy Bloomberg LP (c) 2019]