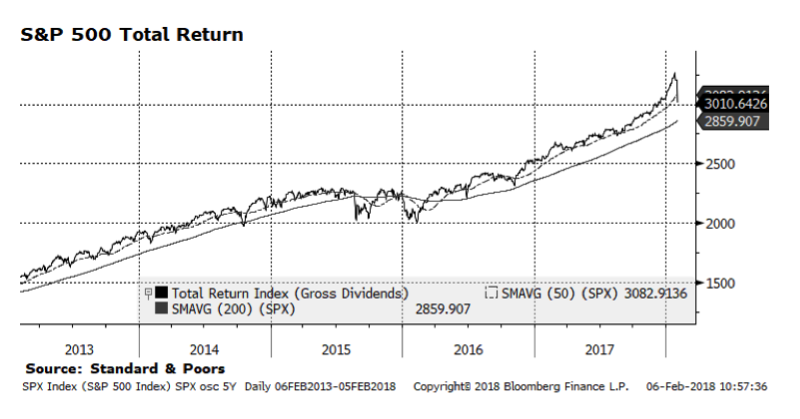

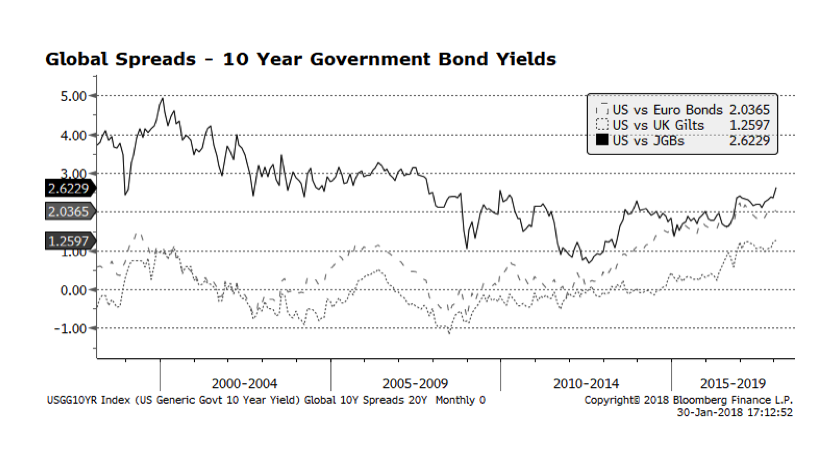

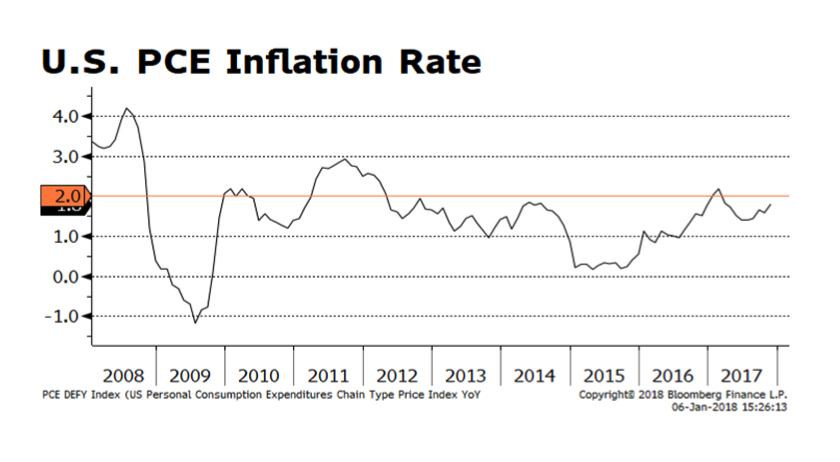

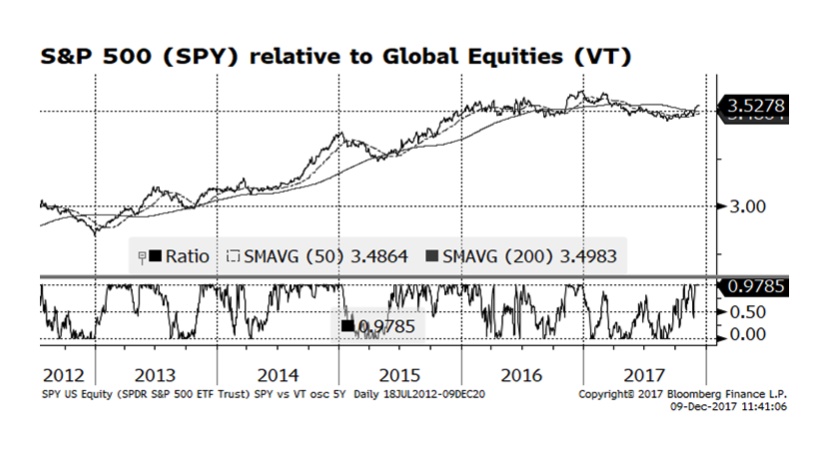

The last few trading sessions in stock markets around the globe have been painful. The sell-off on Friday February 2nd was the steepest in nearly two years, only to be followed by a deeper fall Monday. The prompt for the market rout appears to be a strong jobs report in the US that included signs of increasing wage inflation. Benchmark interest rates, in turn, rose with the yield on the 10-year U.S. treasury climbing to 2.84% on Friday only to fall to 2.7% on Monday evening. The perception that interest rates may rise faster than the market expects unnerved equity investors. In our view, the US stock market is consolidating strong gains posted over the past year and its longer term trends are still upward-sloping. With economic conditions showing continued improvement and corporate earnings accelerating, equities should resume their upward trajectory after this bout of selling pressure recedes. For now, we view the stock market as experiencing a healthy, albeit harrowing, correction.