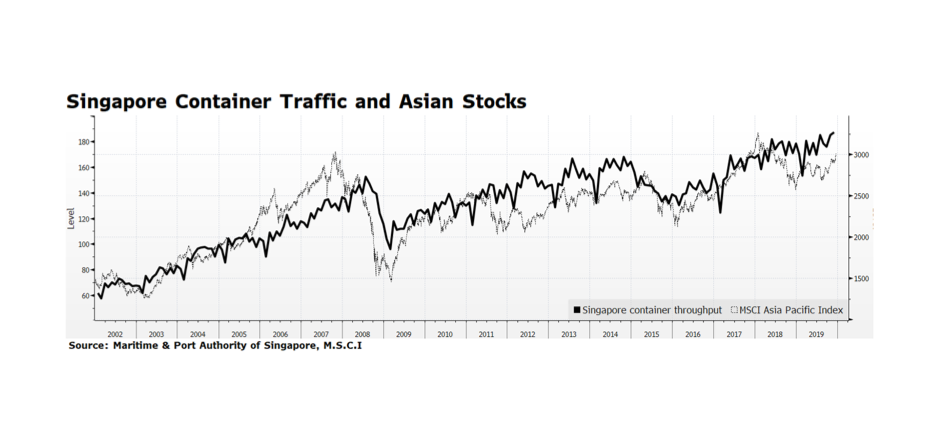

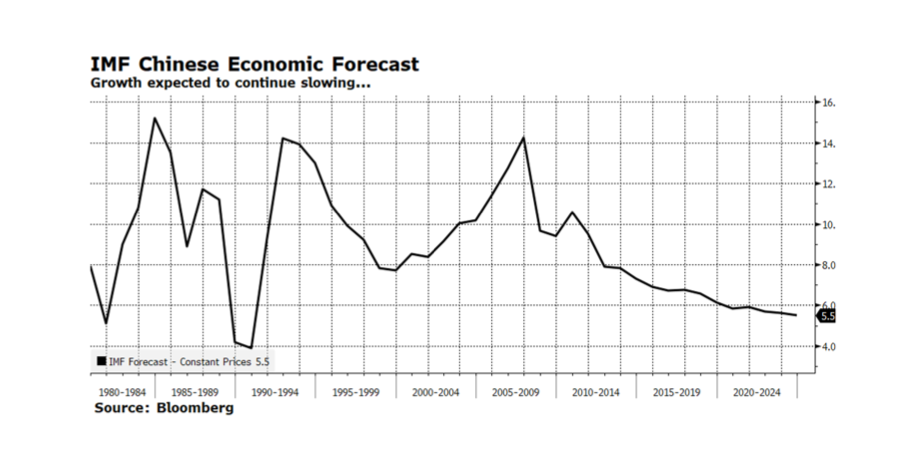

Nothing says holiday cheer like Asian exports. Actually, come to think of it that probably says a lot about holiday cheer depending on what is under your tree, menorah, or Festivus pole. Equities in Asia have been rallying since early this Fall but have underperformed global peers this year. But, on a positive note, container traffic in Singapore just hit an all-time high, which should be supportive of Asia’s bourses going forward. The reason container traffic is important is because it is a barometer of trade momentum in the region and Singapore is a strategic transfer point for goods. Its exports hover around 200% of GDP. Trade flows should continue to improve with Phase 1 of the US – China trade agreement and US House of Representatives passage of the US Mexico Canada Agreement (passage in the US Senate is likely). These developments are critical considering global economic activity is moderating. [chart courtesy Bloomberg LP © 2019 and Maritime & Port Authority of Singapore, MSCI]