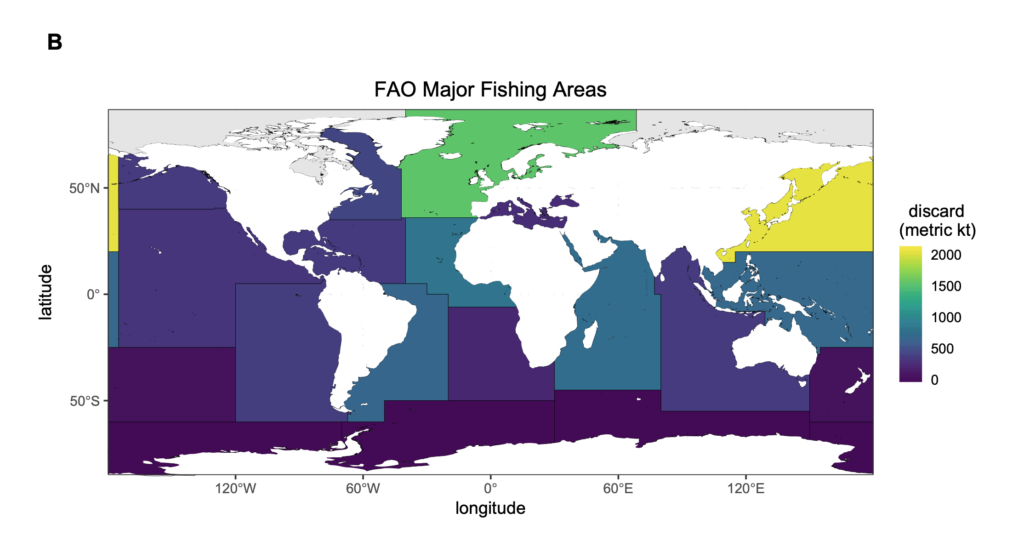

We held this week’s chart until today to coincide with UN World Oceans Day, which lines up well with SDG 14 Life Below Water as well as several other SDGs relating to climate, food and waste. The chart comes from the Food and Agriculture Organization of the UN’s 3rd assessment of global marine fisheries discards (2019), illustrating the thousands of metric kilotonnes of discard by ocean region. Although with a variety of supervisory regimes and certifications and consumer scrutiny the amount of discard and bycatch in commercial fishing is believed to be on the decline, the reality is that the overall annual volume is still alarmingly high. From bottom-feeders to apex predators, the incidental injury to or death of sea animals is not only cruel, it risks destabilizing a critical part of the global food system for humans and irreversibly disrupting an essential part of the global climate system. Consumers and companies can and should continue to exert pressure on seafood businesses to improve the sustainability of their supply chains because it is good for people, planet AND profit. #worldoceansday #bycatch #SDG14