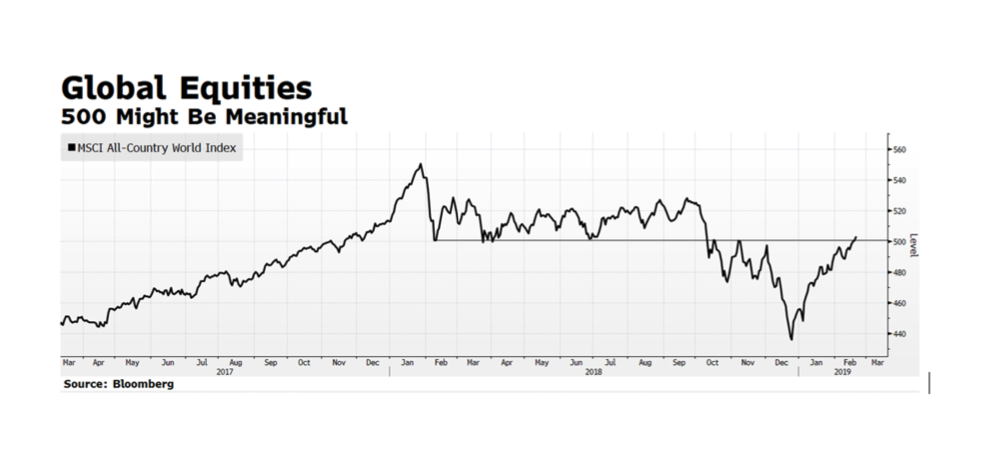

We normally don’t make too much out of indexes that are hovering around round numbers, especially a random number like 500, but for global equities this may be meaningful. The MSCI All Country World Index is a key benchmark for global portfolio managers and over the course of the past year, the 500 level has served as both a level of support and more recently resistance. The index just pierced the 500 mark February 18th and that could provide a psychological lift for investors. The key will be if market leadership can broaden beyond the US stock market and carry the index even higher. While valuations in the US are attractive, earnings growth is slowing. The rest of the developed world does offer value, although growth is still anemic — value alone may ultimately attract investor interest.