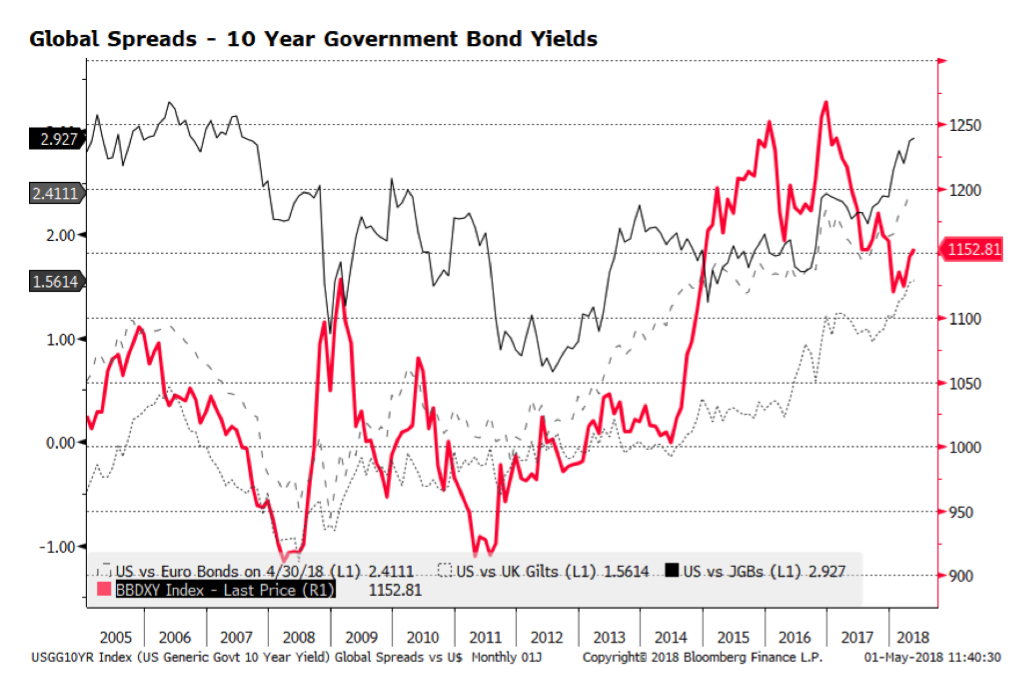

US Dollar strength caught some investors off guard recently as Bloomberg’s DXY index, which measures the dollar versus a basket of major currencies, has risen some 3% over the past three months. Dollar strength could persist if interest rates continue to rise in the US as monetary policy continues to firm, as many including us expect. Meanwhile, central bankers abroad, notably the ECB and BOJ, will likely remain more accommodative given weaker economic conditions—ECB President Draghi indicated as much last week in his post-ECB meeting remarks. The result could be further widening of interest rate spreads across government bond markets.

The strength/weakness of the US dollar represented by DXY, the red line on the chart below, appears to be related to Global government bond spreads among US Treasuries, U.K. Gilts, ECB Bonds and JGBs. Spreads contracted from 2006 until the financial crisis during a period of dollar weakness. The dollar rebounded in the aftermath of the crisis, and over the past decade of extraordinary central bank intervention, the relationship between global spread differentials and the value of the dollar appears to be influential.