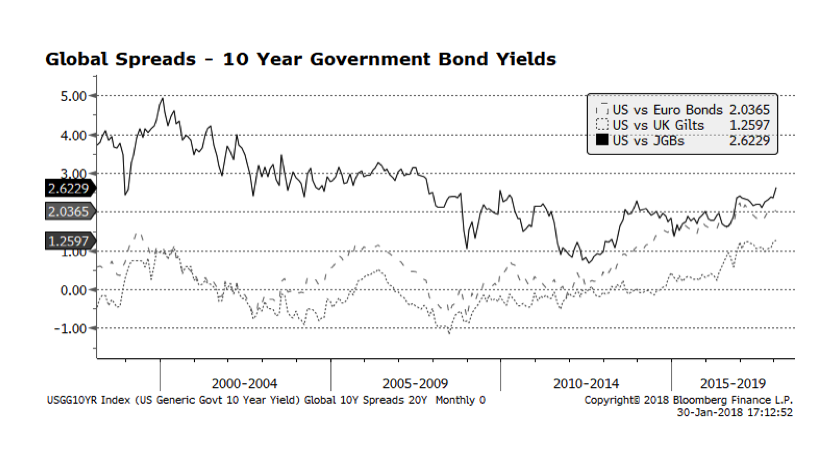

The yield on the 10 Year US Treasury bond reached 2.72% today and has climbed over 65 basis points since early September 2017. This is not wholly unexpected given the strengthening of the US and world economies that has been building over the past several quarters. What we find interesting is that global government bond spreads (the difference between yields in the US and international markets) are staying persistently high, especially in the face of a weakening US dollar. The chart below shows spreads in the US versus comparable yields in the Eurozone, the United Kingdom and Japan going back two decades. US Treasury – Japanese Government Bond (JGBs) spreads have been historically wider, notably in the 2000s, while US Treasury spreads versus the UK (Gilts) and European equivalents are near all-time highs and significantly above 1.0% which served as an upper boundary.

It appears “something has to give” – either the US dollar strengthens, rates in the US recede or yields in Europe rise, thus closing the gap with US Treasury yields. We have our doubts that European economies can absorb materially higher rates even with welcomed improving economic trends.