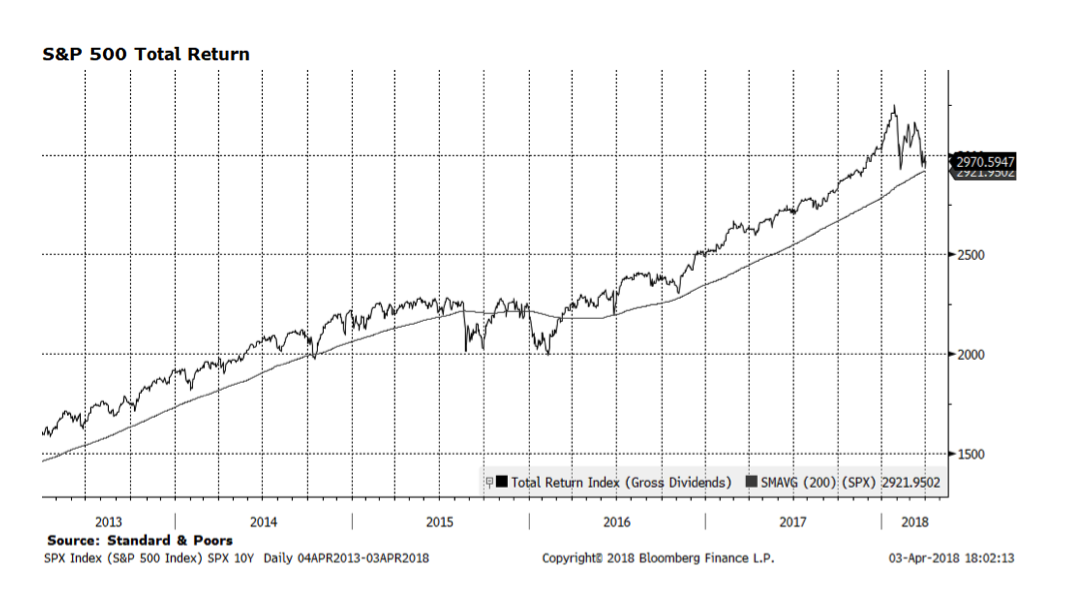

There has been an increased level of volatility in US equities across several key larger capitalization indexes going back to the first week of February. Lately, investors have been attempting to identify what may lead to a market bottom and many have been drawing attention to S&P 500 price levels relative to its 200-day moving average — a key long-term trend measure. On April 2nd the S&P 500 price index closed below the 200-day moving average for the first time since late June 2016. Today, the index recovered and closed slightly above that trend line. The question for investors is whether the correction will deepen or did yesterday mark the resumption of the bull market.

On a total return basis (which we find more relevant as that is what people actually get by investing), the S&P 500 has yet to close below the 200-day moving average. That is critical in our view, although we do acknowledge that this measure is precariously close to turning negative. What appears to be escalating trade friction between the US and China among other trading partners, potentially developing into a much broader trade war, is the most likely reason US equities have entered a corrective phase. The market is now trading at valuations last seen in 2016 which could be a bargain since fundamentals in the US remain strong and earnings are expected to be robust in coming quarters.