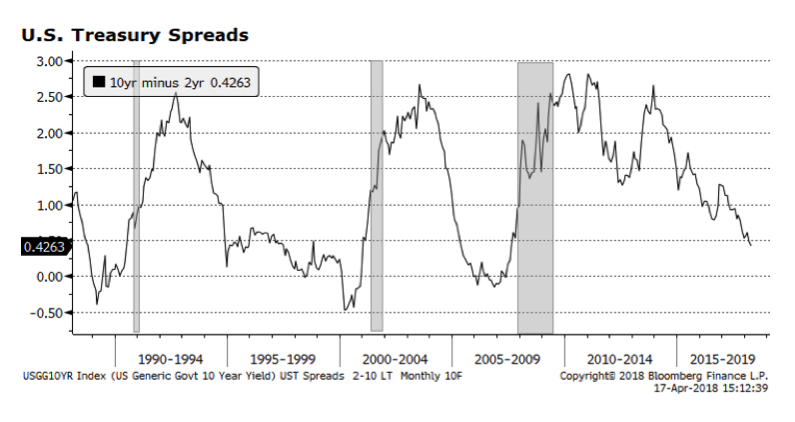

John Williams, current head of the Federal Reserve’s San Francisco branch, will soon be taking over as head of the influential New York branch. He was recently discussing a range of topics including the flattening of the US yield curve, which measures the spread between shorter and longer-term US Treasury rates. The risk is that as the yield curve inverts – when short term rates rise above long term rates – a recession usually follows (represented as shaded areas spanning back three decades).

It appears that we may have some time before the curve inverts, if it does at all. Every cycle is different and this one is unique due to the absolute low level of rates throughout the world. Interest rates in Europe and Japan may anchor US rates lower than they otherwise would be. That, in turn, may distort the shape of the curve in coming quarters and with it change the economic impact.