Investors have been focused on gyrations in the US equity market and rightfully so. It has been quite harrowing to witness the large intraday price swings in the major US indexes as market participants react or sometimes overreact to tariff and trade-related posturing among the Trump administration and trading partners. Our sense is that the market is attempting to establish a new equilibrium once a new global export/import balance is established. A new global balance of trade may not be bad for the world as long as the outcome is truly fairer and freer trade, but still, the uncertainty around this issue has caused painful volatility.

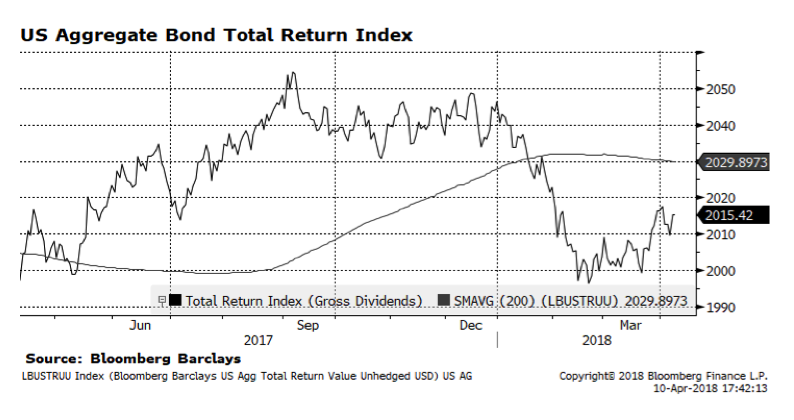

Meanwhile, the US bond market as measured by the Bloomberg Barclays US Aggregate Index depicted below, has offered a relative safe haven at least since mid-February. However, the index is about 1.5% lower year-to-date. We are concerned about rising interest rates in the US and the impact on bond prices and potentially the stock market. In the bond portion of our portfolios we have allocated to investments that are shorter duration and tend to perform better in rising interest rate environments. On the equity side of the equation we have more exposure to less rate sensitive sectors. We view the interest rate environment as a major risk and we believe that the US Federal Reserve will continue to be highly transparent and deliberate as it raises policy rates. Another anchor to interest rates in the US is accommodative central bank policy in the Eurozone and Japan where comparable interest rates are expected to remain low for longer.