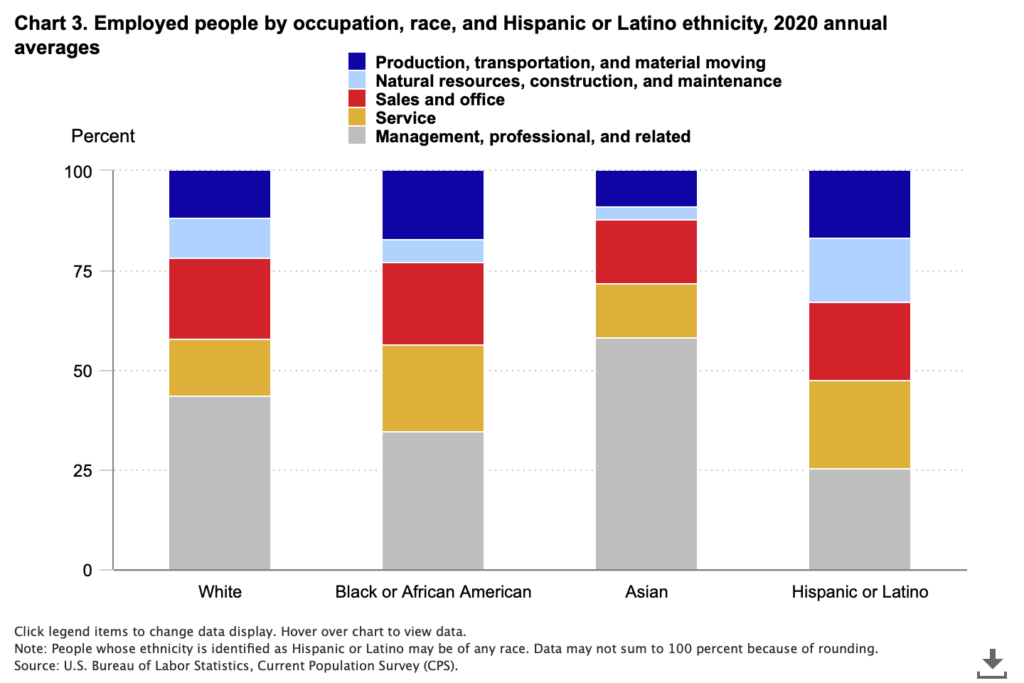

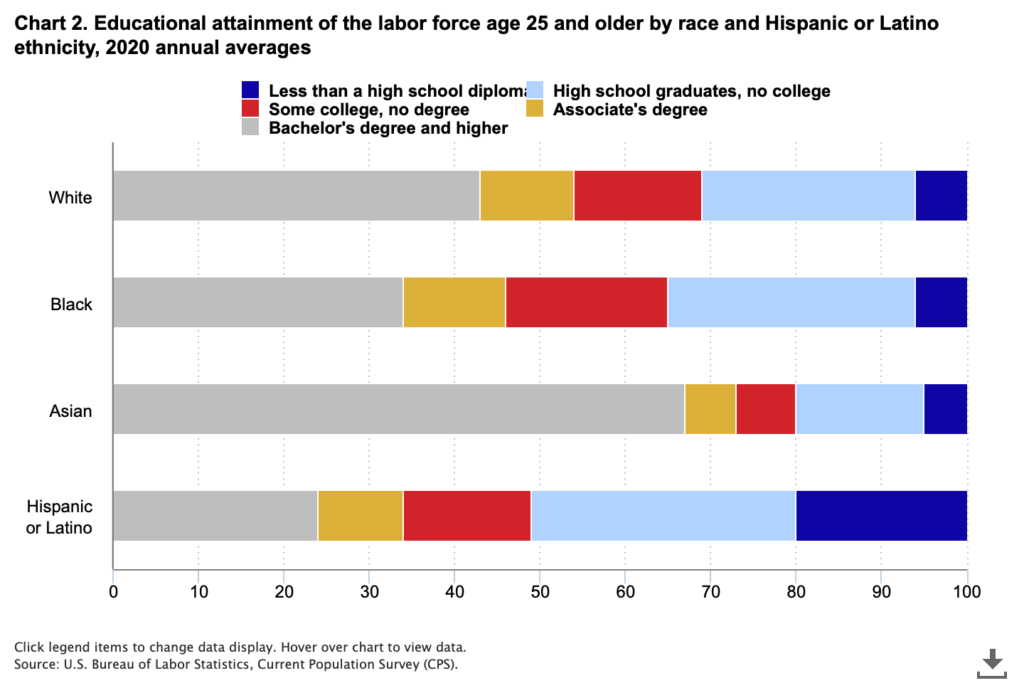

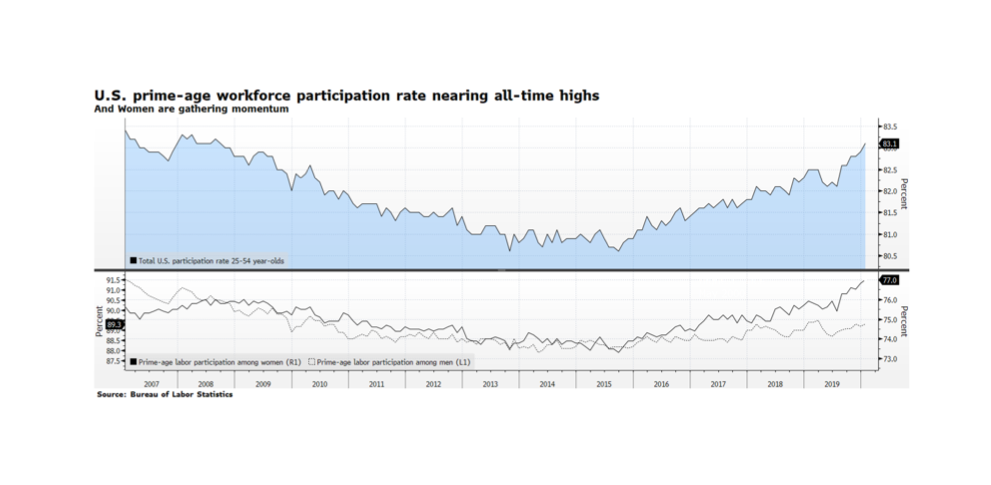

The subject of DE&I – diversity, equity, and inclusion – is having its moment in discussions about companies and workforces. Numerous studies have been conducted attempting to quantify the degree to which all manner of performance metrics improve when access and representation look more like the population at large. We are entirely supportive of a focus on DEI, but not necessarily the focus as it currently stands in the investment world. There is a strong impulse to count and score things to reduce the uncertainty of qualitative observations to quantitative data points, which is not unique to DEI or ESG. DEI happens to lend itself well to that approach because people can be counted. How many women? How many indigenous peoples? How many veterans? What we find is that counting or checking boxes can illuminate deficiencies, but does little to uncover how or why, and fails to understand the interdependencies between different categorizations, such as veterans and health and disability, or race/ethnicity and economic status and education. For instance, a company hiring STEM workers may come up short in its hiring of women or people of color, which could be a failure of policy and practice, or it could be that the supply of qualified candidates is insufficient because universities are not producing a diverse pool of graduates from which to draw. For us, it is a systems-level question. We start with the reasoned assumption that diverse, equitable and inclusive workplaces are more productive and more profitable as well as being more fundamentally just, but our focus is on the systems that perpetuate unproductive biases. That could be and often is rooted in discriminatory practices and systemic biases, but those biases do not exclusively live with the hiring manager or company nor are they fixable in the immediate term no matter how radical a policy shift is implemented. It takes time to establish systems of good governance, cultivate and develop talent, and equalize compensation and promotion opportunities, and those systems extend well beyond the four walls of a given company into our communities and our education, nutrition, health care and other civic services. High performance through an ESG lens where DEI is concerned is establishing and fostering systems and processes that naturally produce a more representative workforce by developing and improving the capability and capacity of candidate workers and opening access to opportunities. [charts courtesy US Bureau of Labor Statistics, Current Population Survey]