There is so much brilliant historical and current writing on the significance of this day that we eagerly defer to the scholarship around it for the authoritative sociopolitical and historical view. Our business is of course investing, and we are taking today to reflect from an ESG perspective on how chattel slavery factors into where people allocate capital and how they benefit. There is a tragic reality that major components of our economy and significant companies and industries have less-than-savory origins connected to the taking of humans and their work, including after constitutional slavery ended and a new form of taking through the carceral and other systems replaced it. This leads to questions of the justice and propriety of investing and profiting where some of today’s prosperity is rooted in historical atrocities. Entire schools of thought have emerged on how to rectify these historical social and economic injustices, and the earliest beginnings of an institutional and societal reckoning are afoot. But, as allocators of capital in the here and now, we recognize that this is not exclusively an exercise in righting wrongs from the 17th to 19th (and early 20th) centuries.

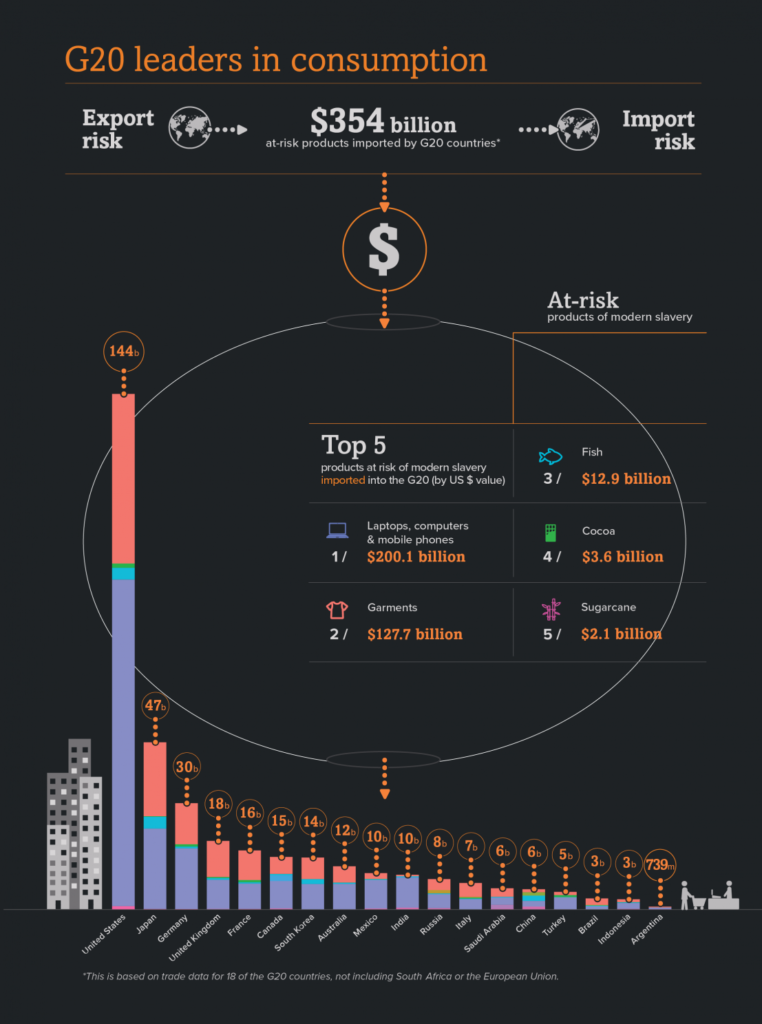

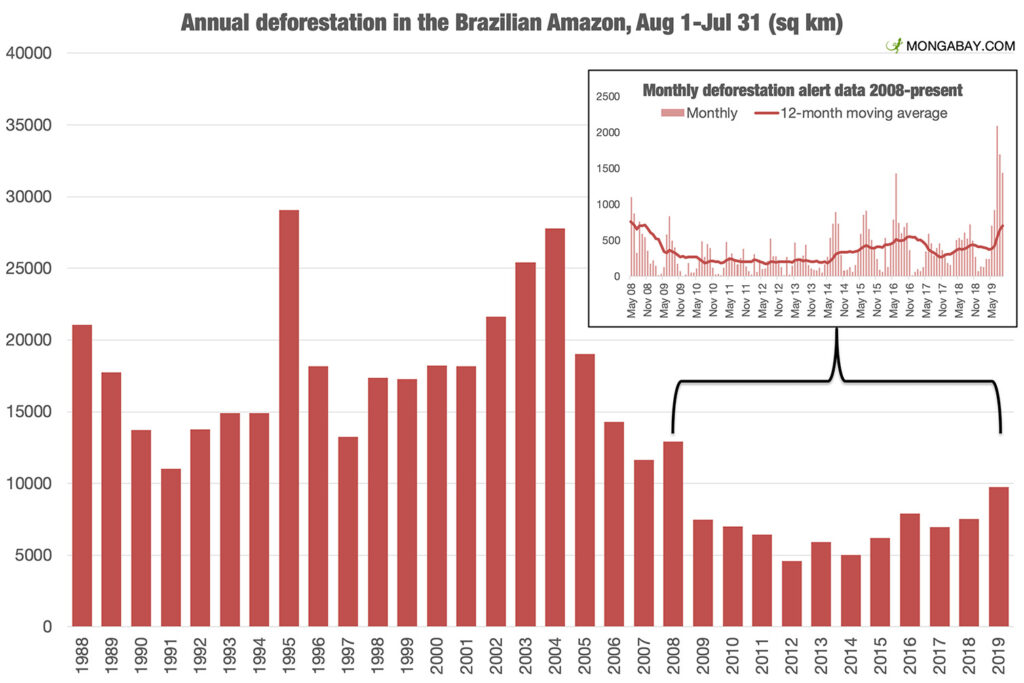

We have written about this before, but it warrants repeating today – according to the 2018 report from the Global Slavery Index, as many as 40 million people globally, the equivalent of the population of California, are in some form of modern slavery, 25 million of which are in forced labor. It is believed that the social, geopolitical and economic stresses of the global pandemic may have further exacerbated this since 2018, and the global rise in inflation may do even more damage in this regard. This is not a contemplation of past deeds or a chapter in a history book. The GSI estimates the risk to imported products by G20 countries at $354 billion, and exposure in just the top 5 at-risk industries crosses technology (computers and mobile phones for instance), apparel, fish, cocoa and sugarcane. It would be difficult to look at any current investment portfolio and not see the potential risk of profiting from slavery in supply chains.

General Order #3 was a monumental moment, but 157 years later there is still work to do in our investing, our consumption and our government policy to truly wring the unjust economic advantages of slavery out of global systems of commerce. [image from the Global Slavery Index (c) 2018]