Our thesis through most of the post-crisis (2008+) period has been that Europe would trail behind the United States economically by about two years, following in our policy footsteps, as well as consumer and investor footsteps. Many of the same forces have been propelling each economy forward, and similar headwinds have been holding each back. One of the most significant factors has been central bank policy. The US Fed moved aggressively to stop the bleeding by employing extraordinary measures to hold back rates and make access to capital cheaper. Fiscal hawks in Europe chose the path of austerity, and the ECB and member countries did not finally come around until the US had lapped them in terms of recovery and growth.

Category: General (Page 16 of 17)

Thanks to Alex Steger for the thoughtful mention of WCM on the CityWire website last night.

“Three former UBS gatekeepers have reunited at an RIA to offer their asset allocation and model portfolio building skills to advisors and wealth managers…”

Click this link to open a PDF of the article, or click here to visit CityWire’s site directly.

To no surprise, the Federal Reserve voted to raise its short-term interest rate target yesterday. The move brings the federal funds rate – the overnight lending rate between banks – to a range of 0.50% – 0.75%. The market expected this move based on recent Fed governor comments and the trends of its two primary bogeys: employment and inflation. With unemployment at 4.6% and inflation moving toward the 2% target, the planets were in alignment for the rate move. No doubt the committee members were also influenced by President-elect Trump’s stated policy agenda of fiscal stimulus, tax reform and regulatory reform, all of which should serve to spur U.S. economic growth (although there was no mention of these considerations in the Fed’s post-meeting statement).

Although the Fed met near-term expectations, markets sold off yesterday as investors assessed the latest “dot plot” which details the anticipated trajectory of rates over the next few years. The chart indicates three rate increases in 2017, an increase from two in the Fed’s September statement. More rate increases translate to higher borrowing costs which could stilt the impact of Mr. Trump’s intended policy actions, giving investors pause. But, a lot of factors will determine the future path of interest rates – investors shook off their initial concerns and the equity rally resumed today.

At WCM, we view the Fed’s actions as progress towards interest rate and central bank policy normalization. As asset allocators, we look forward to the time when market returns are driven by corporate earnings, economic fundamentals, and valuation, rather than monetary policy manipulation.

Not where we expected, and not where most market observers expected either. Putting the US Presidential election to the side for the moment, the 9% US equity market swoon to open the year left people thinking finishing the year flat would have been satisfying. Finishing the year with a return of inflation plus a dividend would have been a triumph. Right now we are looking at a market that is up as much in the closing weeks of the year as it was down in the opening weeks, which is heroic.

Getting the razor out and cutting a little more finely, the recent bottom on November 4th had us very close to expectations – flat to barely positive. Looking just at that US large cap equity return, for all intents and purposes all of the YTD return came since the election. What about the rest of the world? In equity terms, varying degrees of the same good news. Germany, Japan and others similarly bounced off an early November bottom. Even the UK is showing mild resilience. Returns are not as dramatic, but still bucking expectations. Populist revolts are not supposed to signal a good climate for investing in businesses, but there it is.

Counter intuitiveness extends into the bond market as well. Yields rise and equities are supposed to fall. But, the benchmark 10 year Treasury yield has climbed 70bp over the same period as the equity returns discussed. We can assume the anticipation of Fed action to raise rates, a more business-friendly policy climate in Washington DC, and a general sentiment that the dollar is a haven, account for the positivity of equity buyers.

Where does it go? Markets may need to re-rate equities based on the new political climate. Valuations looked full assuming a more-or-less status quo election outcome. But now, in an environment of US-first, business-first governing there may be a case to revisit corporate prospects, at least for those companies with US-centric workforces and supply chains. This may be a case for investing in small- and mid-sized companies that are generally more likely to be home biased in their inputs and customers. As for bonds, that “thud” we just heard may be the other shoe finally falling (along with bond prices) after years of anticipation.

We have just published our monthly wrap-up with some post-US election observations about effects on the capital markets.

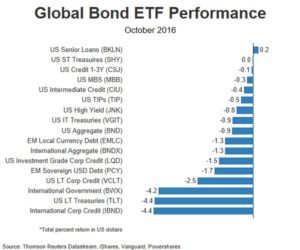

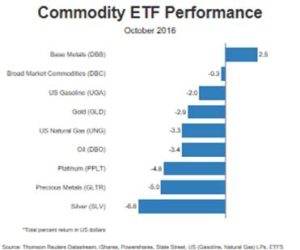

Investors witnessed a wide divergence in performance across capital markets in November. U.S. equities and segments of the commodity markets rose while most non-U.S. asset classes and bond markets within the U.S. declined.

It may have been an ugly process, and it may not have been the outcome that half the electorate wanted, but the rising certainty that Hillary Clinton had a clear path to the White House instilled some degree of comfort in global markets. Clinton being more or less a status quo candidate, market participants could at least anticipate an environment of incrementalism in matters of trade, healthcare, social and environmental policy, particularly if she found herself squaring off against an opposition party legislative branch. The prospects with the more mercurial Donald Trump and his platform of disruptive change were far more uncertain. His adversarial stance on foreign trade and immigration, his desire to abruptly terminate ACA, and deregulatory mindset would likely introduce a great deal of volatility in work markets simply because investors are unsure how to “trade Trump”. This is not an assessment of the relative merits of either candidate – only an observation that markets tend to be better behaved when there is greater clarity on policy.

There have been so many “October surprises” so far that little else could have been envisioned. We had both Trump’s and Bill Clinton’s peccadilloes with women discussed and even paraded before the cameras, repeated hacks and Wikileaks disclosures of the DNC’s and Clinton campaign’s internal correspondence, and unprecedented animosity on stage in the debate arena. It figures when the bar of surprise was already raised so high that it would take an Olympic pole vault to clear it, and FBI Director James Comey took his run at it last Friday. His letter to Congress regarding the possible pertinence of emails from the Anthony Weiner “sexting” investigation to the Clinton email investigation was profound in its electoral implications on its own, and was further compounded by the posting of files from the end of Bill Clinton’s Presidency pertaining to the pardoning of Marc Rich. Director Comey has put the FBI and Justice Department in the unprecedented position of being a last-minute spoiler in a Presidential election. Polls immediately tightened, Republicans closed ranks, and the election picture got a lot fuzzier.

Our concern as investors is not that Trump’s odds have improved. It is that we have lost a lot of confidence in the outcome, and that either candidate as a winner comes with a lot of potential disruption in his or her wake. We now face the prospect that Clinton as President-elect could be mired in controversy, Federal investigation, and worst-case, if there actually is fire to go with the smoke, that she could be indicted before she ever takes the oath of office. Add to that the rhetoric attempting to delegitimize election results ahead of the polls and we could be facing turbulent times ahead. The status quo candidate has become anything but. The Washington outsider, followed by his own controversies and lack of clarity on how he would build his administration, presents no more certainty.

The third and final U.S. Presidential Debate was Wednesday and the general consensus is that Hillary Clinton was the winner (although the impact of later debates tends to be less than initial ones). The reaction in the markets was a virtual yawn and it appears that investors moved on. Any market movement in coming days will likely be reactions to other headlines including that U.S. jobless claims increased after spending several weeks at a four decade low or that the European Central Bank (ECB) is keeping its quantitative easing program and interest rates unchanged. While we have seen some predictability in the market this should not be confused with health or strength. We have observed a persistent pattern of fragility, including a U.S. market, as measured by the S&P 500, making lower highs and lower lows, that has become more apparent since this Summer. Interest rates, both policy and market, are near zero and in some cases negative, equity and bond market valuations are full or extended based on several common measures, and the policy cupboard is becoming increasingly bare. Our concern is that there is little that would be welcomed by the market in either candidate outcome, and given tenuous fundamentals and economic conditions, capital markets could react adversely to any unexpected bad news.

Global equities outperformed global bonds during the month of September with many of the more volatile markets within both asset classes delivering the highest returns. (Revised Nov. 1, 2016 for typographic error)

Click here to read the rest of the newsletter.