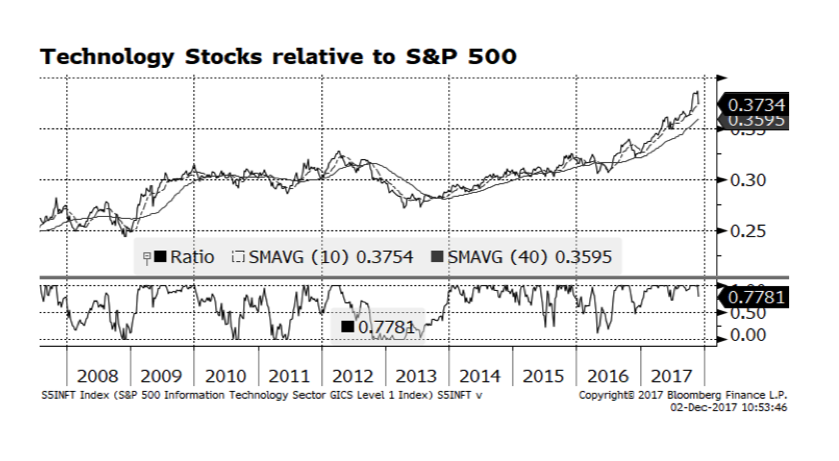

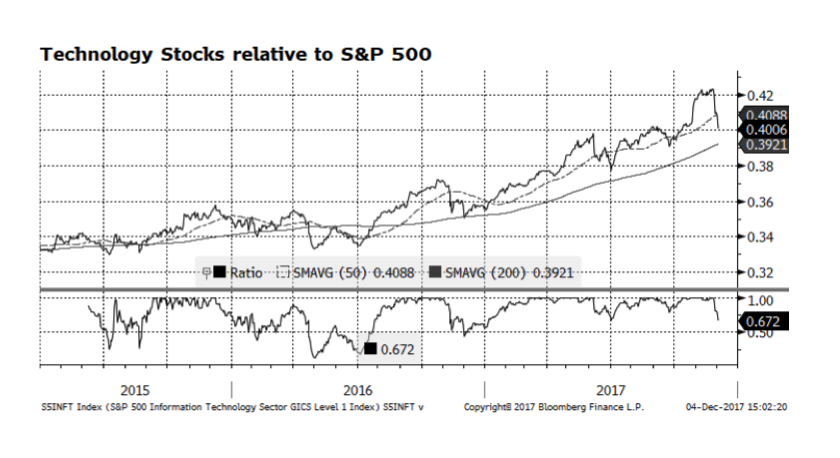

A key sector takes it on the chin…

The US technology sector has been a key leader in the US stock market for the past several years, and this year has been no exception. Yet, the past few weeks have seen a number of dominant technology companies’ stock prices stumbling while the broader market continues to rise. The sector has given back quite a bit of outperformance in a short period of time as the market appears to be rotating away from more growth-oriented toward more value-oriented sectors. The question remains whether the technology sector is simply consolidating outsized gains or does this truly mark a change in market leadership. Technology valuations are trading at a premium to the overall stock market, but not at historical extremes. So, for the time being we view the past few weeks as a healthy consolidation and we will continue to monitor this key position.

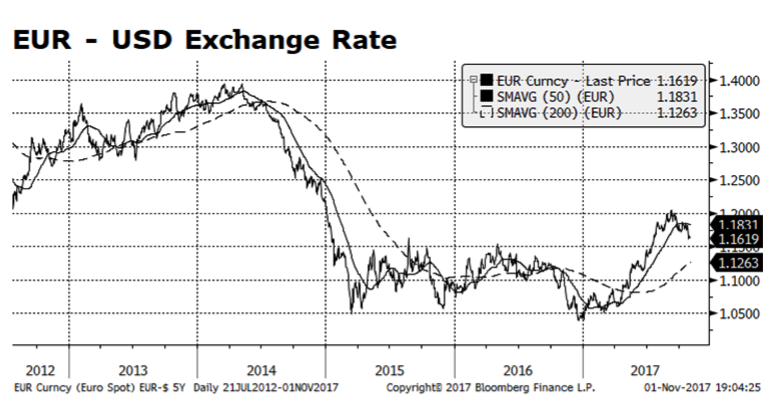

We still believe that, longer term, the probability the Euro/USD exchange rate heads towards 1.30-1.35 is a reasonable expectation based on signs that the region’s economy is mending. However, recent developments have sent the Euro lower versus the dollar. Much of the weakness may be attributed to the Spanish federal government’s decision to dissolve Catalan regional autonomy, which has created a considerable amount of social unrest. The Euro is currently trading around 1.16 which is critical because it is below its intermediate term trend and sentiment could force it even lower.

We still believe that, longer term, the probability the Euro/USD exchange rate heads towards 1.30-1.35 is a reasonable expectation based on signs that the region’s economy is mending. However, recent developments have sent the Euro lower versus the dollar. Much of the weakness may be attributed to the Spanish federal government’s decision to dissolve Catalan regional autonomy, which has created a considerable amount of social unrest. The Euro is currently trading around 1.16 which is critical because it is below its intermediate term trend and sentiment could force it even lower. I have two Salvador Dali prints hanging near the front door, perhaps to remind me that the surreal is present everywhere. This afternoon hearing and reading reports from Catalonia my thoughts kept wandering back to the image of the burning giraffes in this Catalan’s work. In the space of hours, we went from President Puigdemont and the Catalan Parliament declaring an independent and sovereign state to PM Rajoy invalidating the declaration and moving to dissolve the regional government. The EU and many of its individual members declared an ongoing commitment to Spain as a unified member state. Desires to restore and expand provincial autonomy that Catalans had tasted and lost multiple times over the last century come into direct conflict with Madrid’s desire for control and stability and Europe’s greater vision of unity and harmony. Nationalistic and nativistic impulses have been on the rise across Europe, but where the boundaries are drawn depends on who holds the pen.

I have two Salvador Dali prints hanging near the front door, perhaps to remind me that the surreal is present everywhere. This afternoon hearing and reading reports from Catalonia my thoughts kept wandering back to the image of the burning giraffes in this Catalan’s work. In the space of hours, we went from President Puigdemont and the Catalan Parliament declaring an independent and sovereign state to PM Rajoy invalidating the declaration and moving to dissolve the regional government. The EU and many of its individual members declared an ongoing commitment to Spain as a unified member state. Desires to restore and expand provincial autonomy that Catalans had tasted and lost multiple times over the last century come into direct conflict with Madrid’s desire for control and stability and Europe’s greater vision of unity and harmony. Nationalistic and nativistic impulses have been on the rise across Europe, but where the boundaries are drawn depends on who holds the pen.