Another trip around the sun leading to another Earth Day, our second of the pandemic. Amid all the trauma, last year we got a brief glimpse of what hitting the pause button on our use and overuse of the planet would yield. Fresher air, cleaner water, wildlife in the canals and in the streets. We conducted an unintended (and unwanted), all-in global experiment, and graphically demonstrated that the environment does have the capacity to respond to behavioral change on the part of humans.

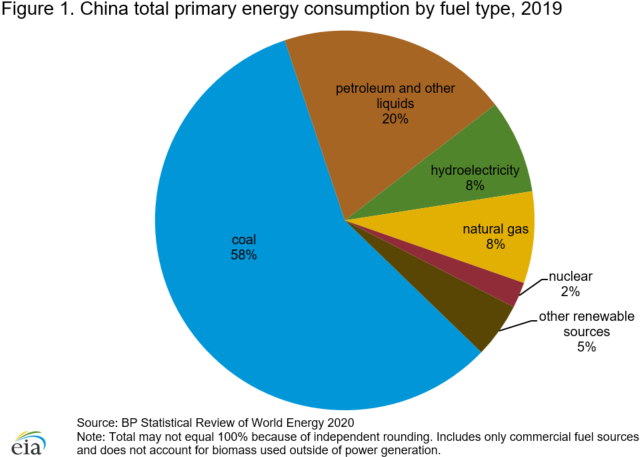

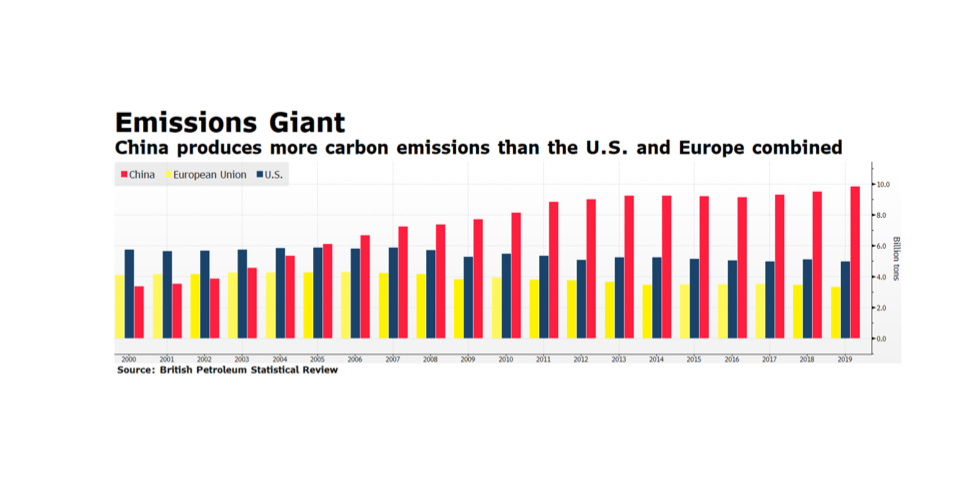

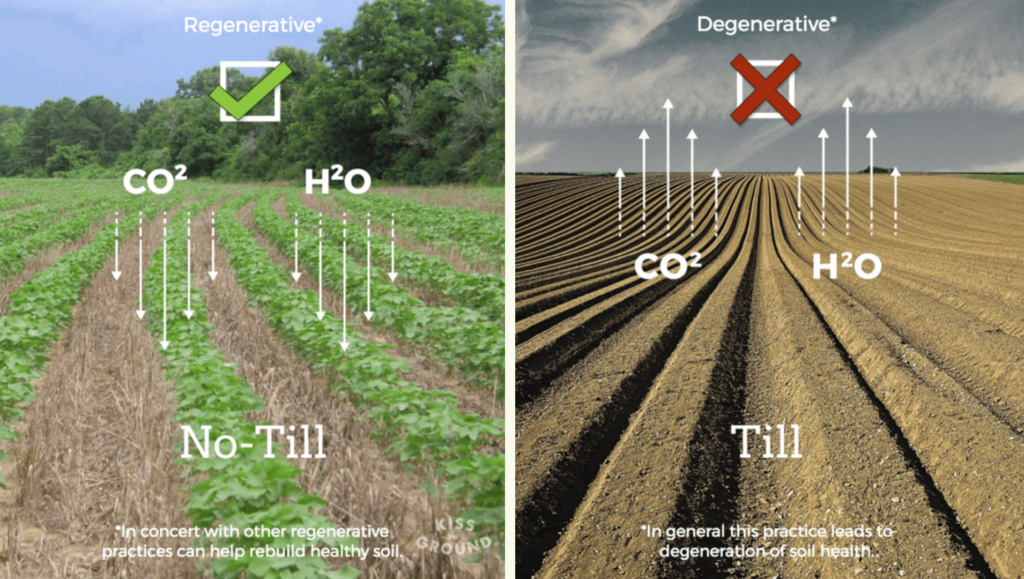

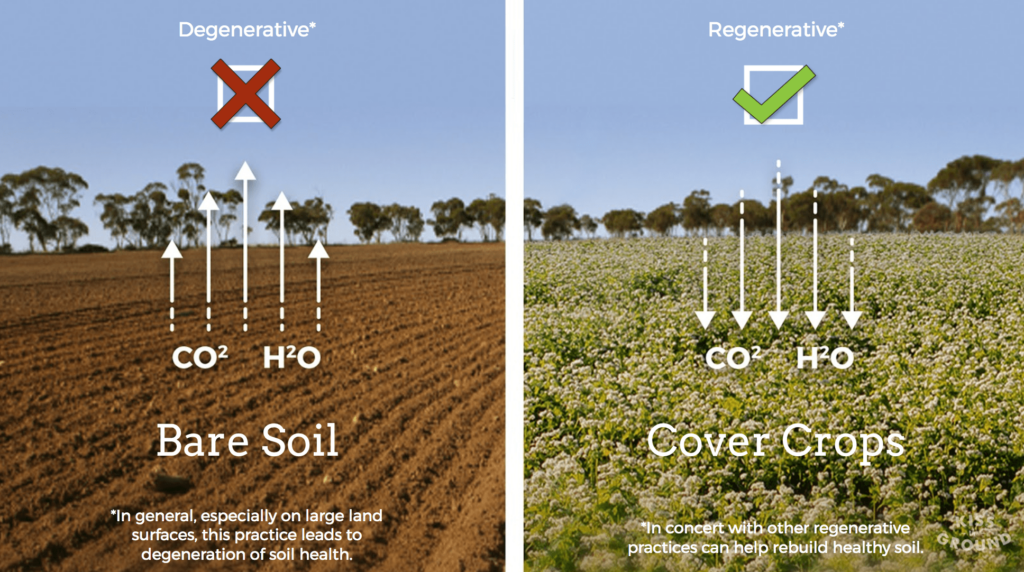

Stopping everything isn’t the answer. But changing everything could be. This planetary test case provided strong evidence against the argument that global systems are too vast and too complex, and changing human patterns wouldn’t result in any sort of improvement. A change from extractive to regenerative processes in food, energy, materials, housing, and transportation among others not only can help address the challenge of sufficiency but also manage our footprint so we live with rather than just on Earth. There is still time to stop and possibly even partially reverse the mounting damage to atmospheric, oceanic, littoral, arborial and other global systems. The risk of not taking those steps is existential for humanity, and it is also bad capitalism. Wildfire, inundation, desertification, loss of pollinators, extreme weather, even glacial collapse have real economic consequences from interrupting supply chains to destroying value in the billions and trillions of dollars.

Moving to more regenerative businesses and communities will mitigate or even prevent some of these risks from manifesting, and will be more equitable and inclusive and result in more financial opportunity for individuals and entire markets. The best possible investment is one that both reduces risk and catalyzes growth at the same time. Caring for the planet we live with is also the best possible free option to get on that trade.

#TurtleIsland