We invite you to check out our Library and the latest addition, a brief white paper on asset allocation for individual and institutional investors.

Author: WCM (Page 9 of 9)

It may have been an ugly process, and it may not have been the outcome that half the electorate wanted, but the rising certainty that Hillary Clinton had a clear path to the White House instilled some degree of comfort in global markets. Clinton being more or less a status quo candidate, market participants could at least anticipate an environment of incrementalism in matters of trade, healthcare, social and environmental policy, particularly if she found herself squaring off against an opposition party legislative branch. The prospects with the more mercurial Donald Trump and his platform of disruptive change were far more uncertain. His adversarial stance on foreign trade and immigration, his desire to abruptly terminate ACA, and deregulatory mindset would likely introduce a great deal of volatility in work markets simply because investors are unsure how to “trade Trump”. This is not an assessment of the relative merits of either candidate – only an observation that markets tend to be better behaved when there is greater clarity on policy.

There have been so many “October surprises” so far that little else could have been envisioned. We had both Trump’s and Bill Clinton’s peccadilloes with women discussed and even paraded before the cameras, repeated hacks and Wikileaks disclosures of the DNC’s and Clinton campaign’s internal correspondence, and unprecedented animosity on stage in the debate arena. It figures when the bar of surprise was already raised so high that it would take an Olympic pole vault to clear it, and FBI Director James Comey took his run at it last Friday. His letter to Congress regarding the possible pertinence of emails from the Anthony Weiner “sexting” investigation to the Clinton email investigation was profound in its electoral implications on its own, and was further compounded by the posting of files from the end of Bill Clinton’s Presidency pertaining to the pardoning of Marc Rich. Director Comey has put the FBI and Justice Department in the unprecedented position of being a last-minute spoiler in a Presidential election. Polls immediately tightened, Republicans closed ranks, and the election picture got a lot fuzzier.

Our concern as investors is not that Trump’s odds have improved. It is that we have lost a lot of confidence in the outcome, and that either candidate as a winner comes with a lot of potential disruption in his or her wake. We now face the prospect that Clinton as President-elect could be mired in controversy, Federal investigation, and worst-case, if there actually is fire to go with the smoke, that she could be indicted before she ever takes the oath of office. Add to that the rhetoric attempting to delegitimize election results ahead of the polls and we could be facing turbulent times ahead. The status quo candidate has become anything but. The Washington outsider, followed by his own controversies and lack of clarity on how he would build his administration, presents no more certainty.

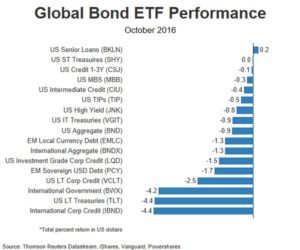

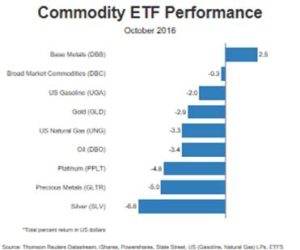

Global equities outperformed global bonds during the month of September with many of the more volatile markets within both asset classes delivering the highest returns. (Revised Nov. 1, 2016 for typographic error)

Click here to read the rest of the newsletter.

Traditional media, blogs and social networks were lit up last night for the highly anticipated first Trump-Clinton presidential debate moderated by Lester Holt. The only thing certain is that nothing is certain. Depending on the particular axe a media outlet, writer, commenter or pundit has to grind, the perspective on who won is different. This is not high school debate club. No points are given so winners and losers are entirely a matter of opinion.

We are not going to offer our own capsule review and call a winner. To us that is not what is relevant to our decisionmaking process. What is relevant is how the markets reacted during and after the debate. We will not succumb to short-termism and try to game a quick surge in Mexico when Donald Trump takes a shot or play a rally in large US corporates that would benefit from a more conciliatory tax regime when Hillary Clinton gets hit on taxation. But, we do see signal in the noise. Maybe more so than in any election since Carter-Reagan, the differences are stark, and nation-states and markets are reacting to the prospects of each candidate assuming office.

A split electorate means this is anybody’s election. The market, showing some of that disturbing behavior that looks more like Vegas odds-making than price discovery, is trying to handicap an outcome and the implications. Our call for the next half a quarter is for heightened volatility as each candidate’s fortune rises and falls, followed by substantial directional moves when the results become known. WCM is focused on longer-term value and will take advantage of market disruptions from this volatility that create a gap between short-term price and that long-term value.

All eyes were watching yesterday as the Bank of Japan (BOJ) and the U.S. Federal Open Market Committee (FOMC) announced their current decisions regarding monetary policy. There has been increasing doubt regarding the true effectiveness of recent approaches, particularly open market bond purchases (so called “quantitative easing”), in terms of improving economic growth and spurring inflation. In an apparent acknowledgement of that, the BOJ announced that it would change its policy approach and focus on interest rates and the yield curve rather than the money supply. BOJ Governor Kuroda characterized the change as an enhancement to current policy but this can be seen as a significant shift and an acknowledgement that the recent policy of aggressive easing has not produced sustainable economic results. Japanese bank stocks rallied on the news and the yield on 10 year Japanese Government Bonds (JGBs) turned positive. The BOJ remains focused on achieving its 2 percent inflation target.

To little surprise (but frustration in some circles), the FOMC held steady on rates. The Federal Reserve is data dependent and had a weakening case for a rate hike based on recent metrics including retail sales and industrial production data. But, the Fed’s forward guidance indicated its belief that the case for an interest rate increase has strengthened based on indicators including household spending, consumer sentiment and labor market trends. Fed watchers believe that the central bank is setting the table for one hike in 2016, most likely in December.

As the market mantra says, “You can’t fight the Fed”. We will continue to pay attention to central bank policy in the US as well as Japan, Europe and the UK in recognition that, beyond the economic impact, policy moves markets. As market participants, we believe the time for this type of market manipulation has long passed, both from an investment perspective as well as in recognition that the economic benefits are fleeting. Ultimately, we are believers in the fundamental drivers of markets (e.g., earnings growth, valuation). These policies continue to overwhelm the fundamentals (is “risk on/risk off” the new paradigm?) and force active investment managers to disproportionately account for and weight top-down policy in an otherwise bottom-up process. It is time for the central bankers to step back and allow the markets to function on their own.

The world’s riskier areas of the capital markets posted moderate gains in August after July’s sharp rebound in the aftermath of Great Britain’s June referendum to leave the European Union, commonly known as “Brexit”.

Please click on the following link to read our August wrap-up:

Information, careful analysis and thoughtful action are central to our process for managing our clients’ portfolios. Think of this blog as a window into how we think and act every day. It may be an observation on the market, a meaningful data point, an explanation of a change we have made to one or more portfolios, a monthly or quarterly wrap-up, or a capsule of something we found particularly compelling from another source. Welcome and enjoy.