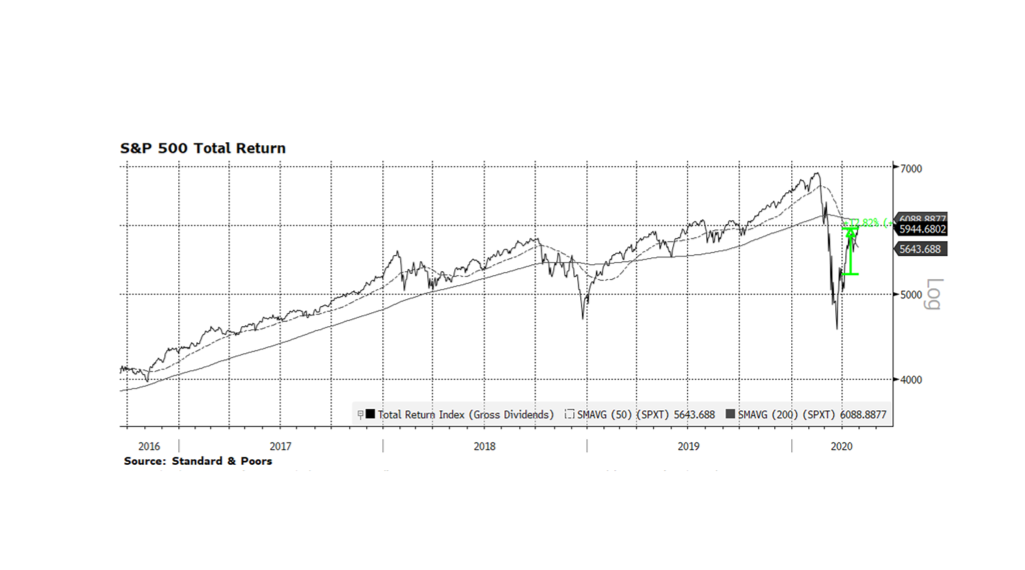

At the peak of the Financial Crisis in the stretch from 2007 to 2009, we became familiar with the notion of systemically important institutions. With the failure of major banks and investment banks like Bear Stearns, Lehman Brothers, Countrywide and Washington Mutual, the private and public sectors had to come to grips with the idea that for-profit businesses could be so essential to the orderly functioning of the overall capitalist system that they could not be allowed to fail, even if that required the rescue of a public company with taxpayer money. This notion gave rise in part to a series of laws and regulations including the Dodd-Frank Wall Street Reform and Consumer Protection Act. Certain financial institutions were too important either by virtue of function or size or both to be allowed to fail, undermining confidence and the orderly conduct of our economy and markets. These institutions would be protected, but they would also be more critically regulated to mitigate the risk of failure.

Whether standing in long lines of anxious neighbors to stock up on staples or watching a public address from the White House rose garden, we have been presented with a new and really more fundamental notion of what a systemically important business is. In fact, the shelter-in-place approach to mitigating the spread of COVID-19 has created a new class of systemically important businesses as we redefine, on the fly, what used to be luxuries like working from home or having household staples delivered as now being existential.

Through the present market turmoil, it is difficult to see this new order clearly, but in the months and years to come we will collectively be forced to reflect on what we are learning through experience now. There are fundamentals to the orderly functioning of communities and societies that we all know intuitively, and yet we continually fail to prioritize until we are tested. Right now we are sitting at the bottom of Maslow’s hierarchy of needs, focusing on physiological and safety needs. That’s health, food, water, shelter, personal security, financial security, and so on. Our current situation is depriving us of the ability to climb further and focus even on social belonging because of the paramount importance of the first two.

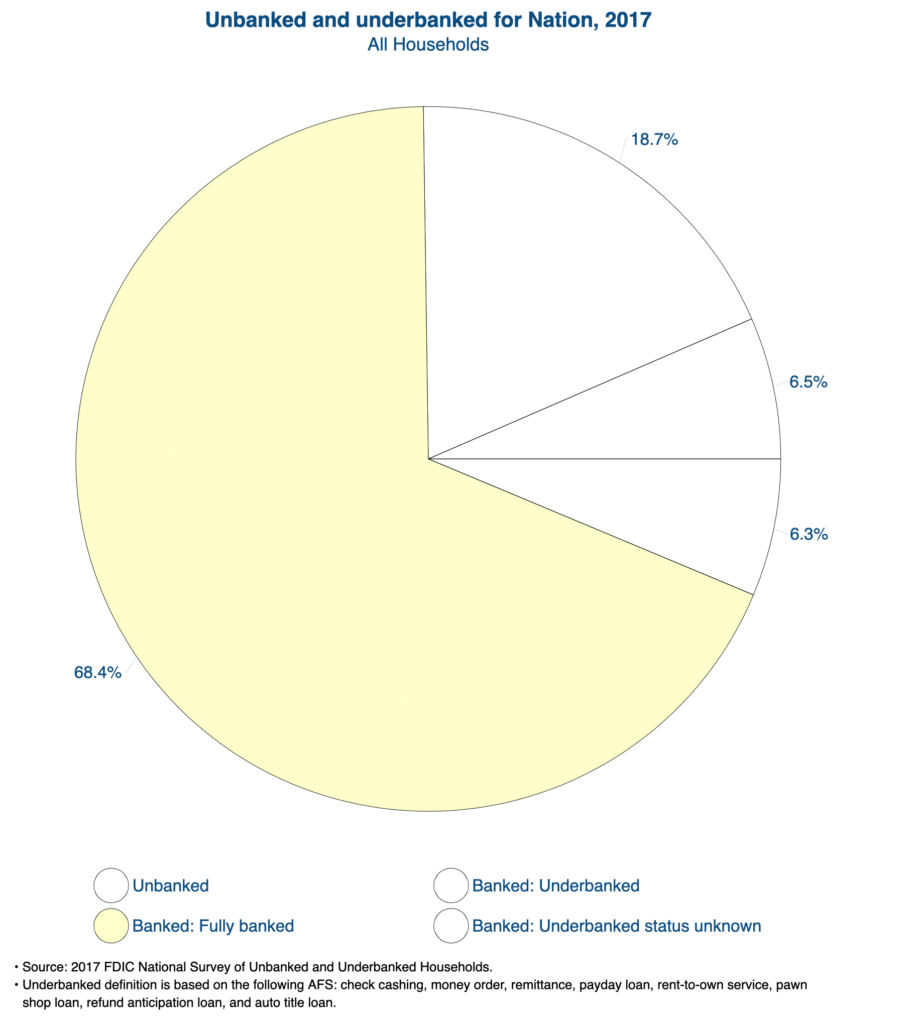

We can make light of the run on toilet paper, canned goods and hand sanitizer, but that is as explicit a manifestation as there is of what matters right now – health and hygiene and nutrition. The systemically important are food producers and grocery stores, pharmaceutical companies and pharmacies, hospitals and laboratories. They are also the providers of basic infrastructure, public and private, that keep the lights on, the water flowing, and goods and services moving from point A to point B so we can be home and be socially distant. We are also going to get a graphic look at how fragile the bottom of the economic ladder is where access to basic physiological and safety needs is not assured on a good day much less in the midst of a crisis.

From an investor’s perspective, this will cause a re-rating of securities according to what really matters when we are against the wall. From municipal finance to support hospitals and emergency workers to ownership of companies that are essential to the food supply chain, we will have a renewed and clarified sense of where our investment capital is the most needed and where it should be treated with the highest levels of stewardship and oversight, whether or not it is backstopped by government, because these companies and services are simply too systemically important to fail. And with that, there is an opportunity for companies and for governments to rethink stakeholder rights and responsibilities, and to provide best-in-class transparency and good governance and prioritize quality and longevity over short term rewards.