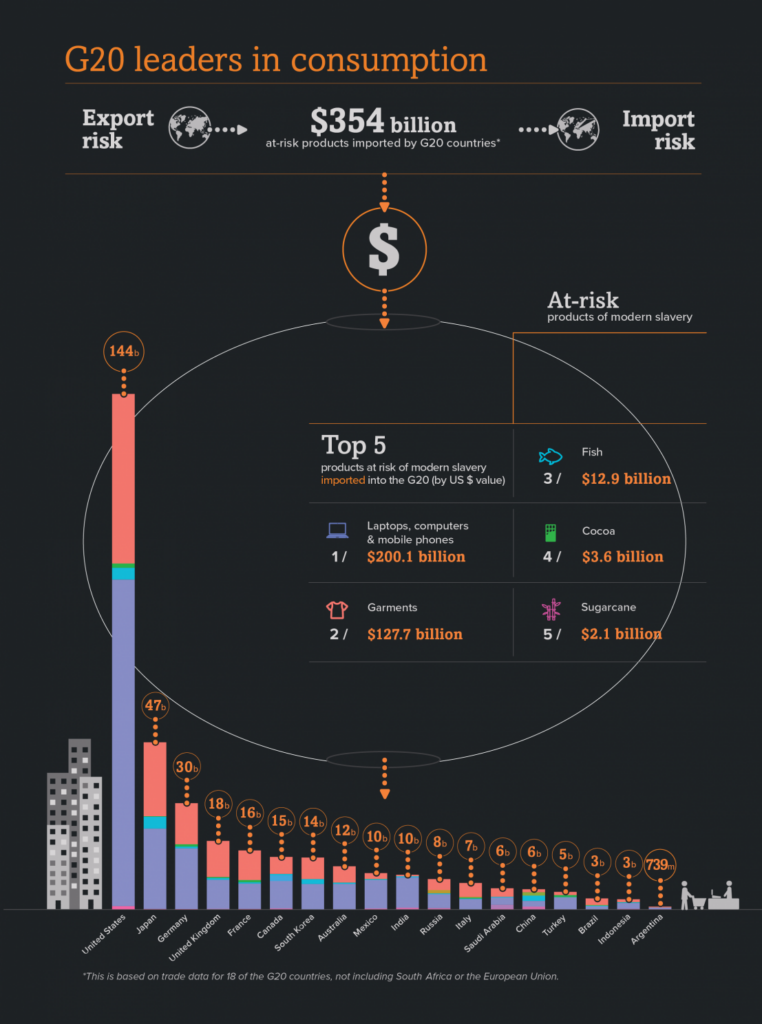

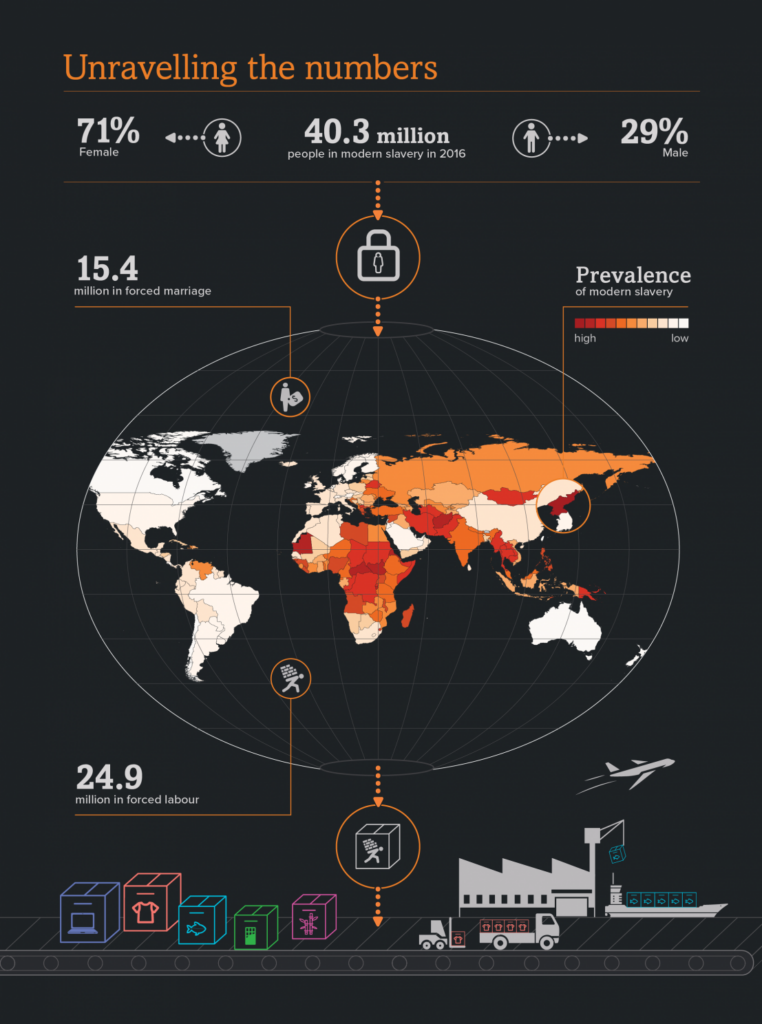

There are few absolutes to be found in the discipline of ESG investing. Most issues and controversies are matters of degree or perspective. However, there are a few issues that rise to a level where there is no shading, no equivalency, no tradeoff that makes them acceptable to any investor or any reasoning human for that matter. Weapons of mass destruction, genocide, and human trafficking contravene all measures of decency, justice, and law and profiting from these atrocities crosses a bright line. In discussing human trafficking in this interview with Michele Bongiovanni of HealRWorld and Distributed Data Network, we begin with the baseline that trafficking is fundamentally objectionable, but we must examine how widespread it is, how deeply it is woven into commerce, and how easy it is to unknowingly benefit or profit from it in the Developed West. 40 million people, the equivalent of the population of California, are exploited for sexual servitude, forced labor or financial gain in any given year, and the Global Slavery Index estimates that $354 billion worth of products imported annually by the G20 are estimated to be ‘at risk of being produced by modern slavery’.

Michele Bongiovanni has more than 25 years of experience leading strategy, product development and innovation in the financial services and media industries for Dun & Bradstreet, Dow Jones & Company, BlackRock and Merrill Lynch. Her vision is to catalyze sustainable business globally with innovative data, products and services to make the world a better place for generations to come.

Currently Michele is founder and CEO of a series of intersecting high-impact global change startups, including HealRWorld, Angels.Inc., Distributed Data Network, and most recently the not-for-profit Music4ClimateJustice initiative.

Selected links on The Business of Human Trafficking

Global Slavery Index 2018 – provides a country by country ranking of the number of people in modern slavery, as well as an analysis of the actions governments

Business Community Affirms that Respect for Human Rights is a Key Contribution to Sustainable Development – Statement in Support of UN Guiding Principles and Sustainable Development Goals, International Chamber of Commerce 2015

Forced labour, modern slavery and human trafficking – International Labour Organization

Photographic chronicle of the human experience of modern slavery – Humanitarian Photographer Lisa Kristine

“Regulating business involvement in labor exploitation and human trafficking“, Alexis A. Aronowitz, Journal of Labor and Society

5th Global Report on Trafficking in Persons, UN Office on Drugs and Crime — Website and Full Report