Silver and gold will be stolen away,

Stolen away, stolen away,

Silver and gold will be stolen away,

My fair lady.

Three attacks in three months, twice on the Bridge. Unfortunately this is a refrain all too familiar to the British not just recently but historically. They have demonstrated their resilience socially and economically since the late 1930’s in the face of small- and large-scale terrorist attacks, and there is little to suggest otherwise this weekend. Much has been said and written already and more is yet to come on the sociopolitical implications of this drumbeat of violence, but our role is to examine the capital markets implications.

We expect UK markets to continue with little change based on this tragic incident. Tangentially related, the unfolding fracas in the Gulf will probably be more material to energy and broader markets as Saudi, Bahrain, and UAE spar with Qatar over terrorism and the Muslim Brotherhood. But, looking down the road just a scant few days, we are keeping a close watch on the snap UK election.

As we wrote previously, T. May calling the election may have propped open the door a notch to some moderation around Brexit if her contingent showed poorly on the 8th. However, the shock of yet another terrorist incident could further harden positions on matters of border security, immigration, and public support programs and propel the Conservatives and UKIP toward a more certain path of disengagement. If the isolationist forces in the UK win out and the moderate Eurocentrics hold the line in the French parliamentary elections later in June, our attention will likely be drawn increasingly to a Europe ex-UK as the reasoned place to deploy capital and own risk outside the United States.

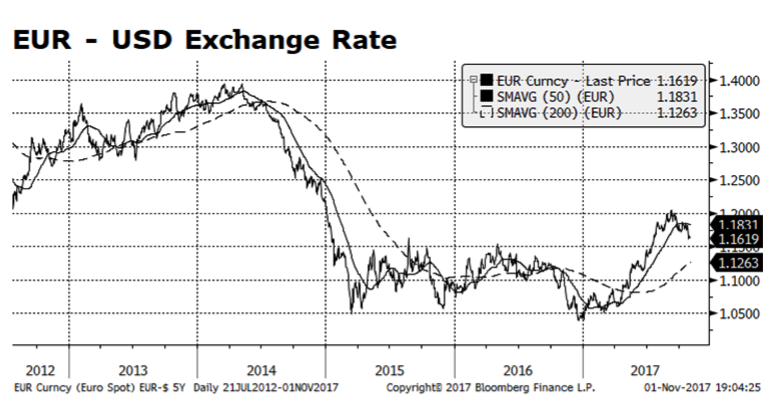

We still believe that, longer term, the probability the Euro/USD exchange rate heads towards 1.30-1.35 is a reasonable expectation based on signs that the region’s economy is mending. However, recent developments have sent the Euro lower versus the dollar. Much of the weakness may be attributed to the Spanish federal government’s decision to dissolve Catalan regional autonomy, which has created a considerable amount of social unrest. The Euro is currently trading around 1.16 which is critical because it is below its intermediate term trend and sentiment could force it even lower.

We still believe that, longer term, the probability the Euro/USD exchange rate heads towards 1.30-1.35 is a reasonable expectation based on signs that the region’s economy is mending. However, recent developments have sent the Euro lower versus the dollar. Much of the weakness may be attributed to the Spanish federal government’s decision to dissolve Catalan regional autonomy, which has created a considerable amount of social unrest. The Euro is currently trading around 1.16 which is critical because it is below its intermediate term trend and sentiment could force it even lower.

I have two Salvador Dali prints hanging near the front door, perhaps to remind me that the surreal is present everywhere. This afternoon hearing and reading reports from Catalonia my thoughts kept wandering back to the image of the burning giraffes in this Catalan’s work. In the space of hours, we went from President Puigdemont and the Catalan Parliament declaring an independent and sovereign state to PM Rajoy invalidating the declaration and moving to dissolve the regional government. The EU and many of its individual members declared an ongoing commitment to Spain as a unified member state. Desires to restore and expand provincial autonomy that Catalans had tasted and lost multiple times over the last century come into direct conflict with Madrid’s desire for control and stability and Europe’s greater vision of unity and harmony. Nationalistic and nativistic impulses have been on the rise across Europe, but where the boundaries are drawn depends on who holds the pen.

I have two Salvador Dali prints hanging near the front door, perhaps to remind me that the surreal is present everywhere. This afternoon hearing and reading reports from Catalonia my thoughts kept wandering back to the image of the burning giraffes in this Catalan’s work. In the space of hours, we went from President Puigdemont and the Catalan Parliament declaring an independent and sovereign state to PM Rajoy invalidating the declaration and moving to dissolve the regional government. The EU and many of its individual members declared an ongoing commitment to Spain as a unified member state. Desires to restore and expand provincial autonomy that Catalans had tasted and lost multiple times over the last century come into direct conflict with Madrid’s desire for control and stability and Europe’s greater vision of unity and harmony. Nationalistic and nativistic impulses have been on the rise across Europe, but where the boundaries are drawn depends on who holds the pen.