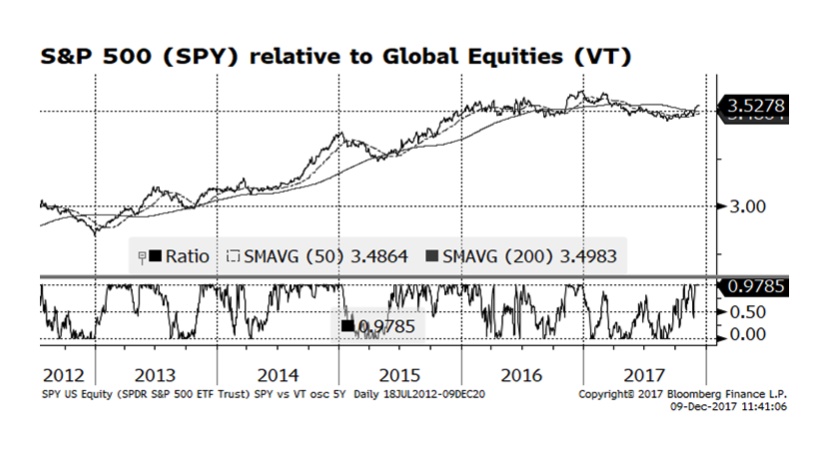

US Large Cap stocks have begun to outpace their global counterparts in the past several months. Stronger employment trends, improving economic activity, moderate inflation measures, expanding corporate earnings and stable, albeit modestly rising interest rates should buffer US corporate securities heading into 2018, in our view.

Author: Mark Sloss (Page 8 of 10)

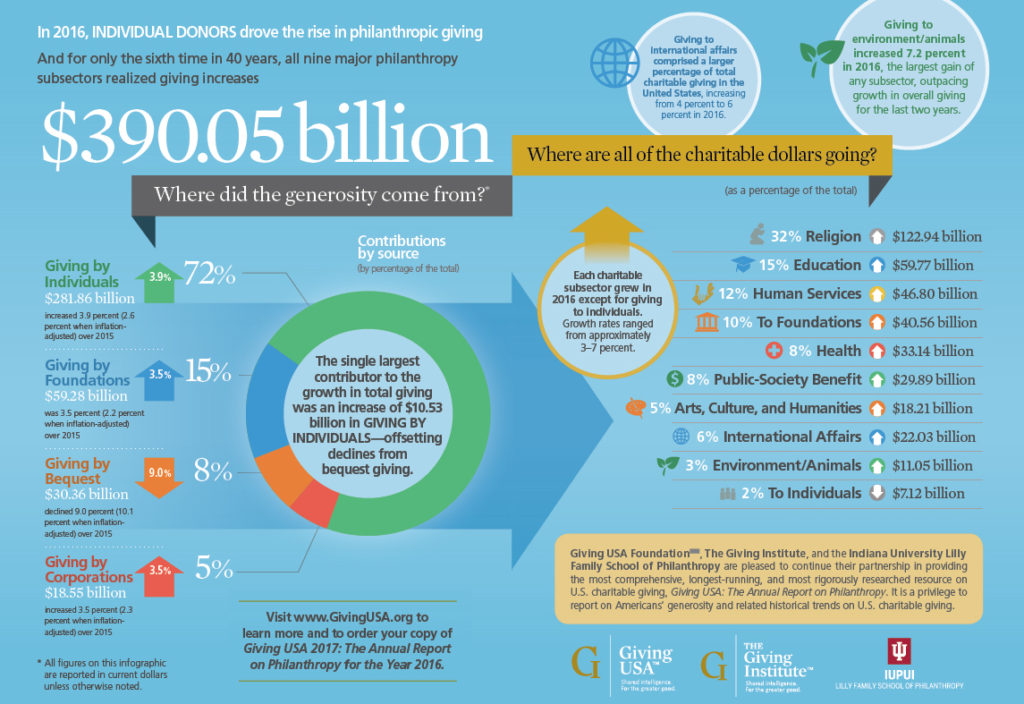

This is a great opportunity for worthy charitable causes that address social and economic justice, health and welfare, the arts, etc. to be in the spotlight on a day for giving. ‘Tis truly the season. The problem is that the need is not only once a year. We stuff the shelves at food pantries for Thanksgiving and Christmas but hunger is a year-round problem. We create this day for giving, but the good works of all these amazing organizations are 365. That charitable spotlight today is bright but it is crowded. It is extremely difficult for every worthy cause to get attention, and with too many hands out at one time donors will tend to concentrate on the few and the favorites.

In the last couple weeks we launched the WCM Charitable Fund, a donor advised fund, in partnership with the Triskeles Foundation. Continue reading

It is with profound sorrow that we make note of the passing of a dear friend and colleague, Harold Yuen, this past weekend. During much of our time as a team in UBS Investment Management, Harold served as the General Counsel to our business. He was always gracious, often humorous, and occasionally bitingly (and deservedly) sarcastic dealing with us. We learned an immense amount from him about how to operate an advisory business in a way that was true to all stakeholders, from our clients to their advisors to the firm and to regulators. At the same time, he taught us how to differentiate between responsible and ridiculous, striking an appropriate balance between observing and honoring the law and letting it suffocate the work we were trying to do for our constituents. It might be best summarized as the practical practice of securities law.

During that time, we also got to be friends and had the opportunity to share in the joys of his life like hearing about his kids’ achievements, and marvel at his extraordinary resilience and spirit as he battled his illness.

This week we say goodbye, but also thank you. He enriched us personally with his friendship, and indelibly suffused what we do as professionals and investors with a sense of both propriety and pragmatism that informed everything we did at UBS, and everything we now do at WCM. Harold, thank you for your friendship and thank you for your counsel. Love ya, man.

— Doug, Jonathan and Mark

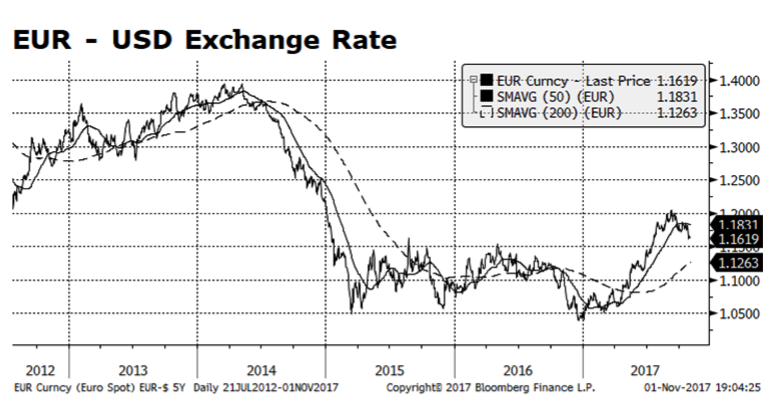

We still believe that, longer term, the probability the Euro/USD exchange rate heads towards 1.30-1.35 is a reasonable expectation based on signs that the region’s economy is mending. However, recent developments have sent the Euro lower versus the dollar. Much of the weakness may be attributed to the Spanish federal government’s decision to dissolve Catalan regional autonomy, which has created a considerable amount of social unrest. The Euro is currently trading around 1.16 which is critical because it is below its intermediate term trend and sentiment could force it even lower.

We still believe that, longer term, the probability the Euro/USD exchange rate heads towards 1.30-1.35 is a reasonable expectation based on signs that the region’s economy is mending. However, recent developments have sent the Euro lower versus the dollar. Much of the weakness may be attributed to the Spanish federal government’s decision to dissolve Catalan regional autonomy, which has created a considerable amount of social unrest. The Euro is currently trading around 1.16 which is critical because it is below its intermediate term trend and sentiment could force it even lower.

At CityWire USA’s recent West Coast conference, several “gatekeeper” attendees were asked followup questions after a conference survey about views on international equities, high yield bonds, and our perennial favorite — what could take this market out. WCM’s views are captured in this excellent synopsis along with the perspectives of several esteemed colleagues across the industry. As we are always quick to point out, it is important to our process not just to be in touch with what we think but also what everyone else has on their minds.

If you have access to the site, the article can be viewed here. Otherwise, follow this link to read a downloaded PDF version of the article.

Gatekeepers gravitate to international equities, exit high yield | Citywire

I have two Salvador Dali prints hanging near the front door, perhaps to remind me that the surreal is present everywhere. This afternoon hearing and reading reports from Catalonia my thoughts kept wandering back to the image of the burning giraffes in this Catalan’s work. In the space of hours, we went from President Puigdemont and the Catalan Parliament declaring an independent and sovereign state to PM Rajoy invalidating the declaration and moving to dissolve the regional government. The EU and many of its individual members declared an ongoing commitment to Spain as a unified member state. Desires to restore and expand provincial autonomy that Catalans had tasted and lost multiple times over the last century come into direct conflict with Madrid’s desire for control and stability and Europe’s greater vision of unity and harmony. Nationalistic and nativistic impulses have been on the rise across Europe, but where the boundaries are drawn depends on who holds the pen.

I have two Salvador Dali prints hanging near the front door, perhaps to remind me that the surreal is present everywhere. This afternoon hearing and reading reports from Catalonia my thoughts kept wandering back to the image of the burning giraffes in this Catalan’s work. In the space of hours, we went from President Puigdemont and the Catalan Parliament declaring an independent and sovereign state to PM Rajoy invalidating the declaration and moving to dissolve the regional government. The EU and many of its individual members declared an ongoing commitment to Spain as a unified member state. Desires to restore and expand provincial autonomy that Catalans had tasted and lost multiple times over the last century come into direct conflict with Madrid’s desire for control and stability and Europe’s greater vision of unity and harmony. Nationalistic and nativistic impulses have been on the rise across Europe, but where the boundaries are drawn depends on who holds the pen.

The Euro showed further weakness this week, perhaps in anticipation. What this will mean for US investors is uncertain. Catalonia accounts for a significant percentage of Spain’s GDP, but Spain as a whole is only 6% of the investable MSCI Europe Index. Any trajectory other than peaceful discussion and accommodation will hurt Spain’s economy, but that in itself does not seem to pose a major investment risk for diversified international investors. However, the potential for contagion to other provinces of Spain and beyond their borders to other parts of Europe that historically enjoyed separate identities could be profoundly disruptive to border permeability, travel, trade, currency and other factors that have made Europe increasingly attractive as an investment prospect in the last year.

This will be an interesting weekend. Keep your eye on the giraffes.

We are pleased to let our followers know that we are launching a “chart of the week” to start conversations, provoke thoughts, open new lines of inquiry, or just cause trouble. The COTW will highlight something that is key to our own deliberations as we think about both our near-term tactical positioning and long-term views for our clients’ portfolios. Look for the chart and brief commentary every Monday.

You can also follow us for the chart and other news and insights —

on Facebook: https://www.facebook.com/wildecapitalmgmt

on LinkedIn: https://www.linkedin.com/company/18290003/

and on Instagram: @wildecapitalmanagement2016

We hope you find these weekly insights useful. We look forward to hearing your thoughts and questions at [email protected] or on our social media accounts.

And now for our first COTW:

It is easy to forget that we are just a scant few decades into Spain recovering from the Franco regime and joining the community of developed democratic Western nations. The echoes of the systematic repression of the Basque, Galician and Catalan regions and identities still ring. Protest, conflict and terrorism have punctuated the post-Franco period as they try to reassert identity, language and culture, and expand the autonomy suppressed after the end of the Second Spanish Republic. These are just a few of many such situations that challenge a liberalized, free and unified Europe.

In the beginning of Act II of Hamilton, Thomas Jefferson returns in the Fall of 1789 from his five years abroad in France as our Minister in Paris and finds himself decidedly out of touch with Post-War America as he prepares to join Washington’s first cabinet as Secretary of State and square off with Secretary of the Treasury Hamilton.

We took a Summer hiatus from writing for the WCM blog but kept our noses close to our screens and made multiple adjustments to the portfolios in August. This blog post was written as a bit of a thought experiment. If we had stepped away entirely at the beginning of July and came back for the Fall like Mr. Jefferson and also asked “What’d I miss?”, what would our reaction be?

The Jefferson character sings “There is no more status quo”. He is referring to France following us to revolution, but looking around in September 2017 in these United States, the same could easily be said here and now. What’d I miss? North Korea is rattling its nuclear sabre, hurricanes batter the Caribbean and South, Nazis and the Klan are marching in Charlottesville, healthcare reform legislation imploded, the previously unassailable bro culture in Silicon Valley is finally being taken to task, the Dollar fell and the Euro was ascendant, and long term rates are closer to 2% than 3%. With Stanley Fischer’s announcement, the Federal Reserve Board is going to have more empty than filled seats. Let’s throw a total solar eclipse in for good measure.

Headlines were blaring that Technology stocks had been beaten down to close the second quarter. Note was made that it was the worst sell-off of these companies in six weeks. Charts are suggesting we may be seeing a change of market leadership and the Tech sector could be in for rough times. In the stock market six seconds is an eternity and six weeks is hardly any time at all. It depends on your objectives and your perspective. Are you a trader or investor?