Headlines were blaring that Technology stocks had been beaten down to close the second quarter. Note was made that it was the worst sell-off of these companies in six weeks. Charts are suggesting we may be seeing a change of market leadership and the Tech sector could be in for rough times. In the stock market six seconds is an eternity and six weeks is hardly any time at all. It depends on your objectives and your perspective. Are you a trader or investor?

We are not traders and were not sellers this week, and here is our reasoning – for now. There are forces at work in the market that have a lot to do with capital flows but little to do with what companies are worth or how attractive their future prospects are. Increasingly the equity markets are dominated by index fund strategies including the exchange traded funds we use to construct our portfolios. These are highly efficient instruments for investing in broad swaths of the market, whether a country, an industry, a sector, a capitalization, a style or a theme. But, at some level these instruments are informationless and so is the trading activity around them. A decision to invest in large capitalization US stocks is largely immunized to the concern about single companies when there are 500 or 1,000 of them in the index or fund being considered. Companies, industries and sectors see capital flow in and out now because they are along for the ride when bigger, broader decisions are being made driven by those indices.

In June, FTSE Russell, one of the biggest purveyors of these indices, goes through a comprehensive reconstitution. One of the key attributes of these reconstitutions is that market and index leaders are brought back in line either through reallocation or reassignment. A small company that had an extraordinary run up on its value and became a dominant position in a small company index may be moved into a mid cap or large cap index at a much more modest weight. This is absolutely the cliché of big-fish-small-pond. The same can be said for the effect on industries and sectors. In order to stay in line with the indexes, portfolios and funds are trading because FTSE Russell says it is time and not because of any fundamental information in that moment about those companies.

Technology has been on a magnificent run since 2009, and the last twelve months have been in keeping with that trend. As a market outperformer, the sector and its constituent companies were bound to be sold back into line – harvest the winners and buy the losers. The amount of capital governed by these indices now means prices will move when they are reconstituted. A lot of selling will put downward pressure on a sector regardless of its fundamental merits. Technology was up to bat in that regard. And so, we experience short-term downward pressure on price for these winners and as if by magic the laggards rally into the end of the quarter.

In a 4th of July tip of the hat to Jeff Goldblum (yes, wrong movie), I will say capital finds a way. If it is leaving Technology it is going somewhere. Finance and Energy seem to have been beneficiaries despite uncertain monetary policy and an oil glut. As investors, we will look to see whether market participants come back this week and find value in a sector that took it on the chin from profit-takers and index funds or if the receding waters reveal something fundamentally weak about Technology that indicates other sectors represent stronger economic prospects going forward.

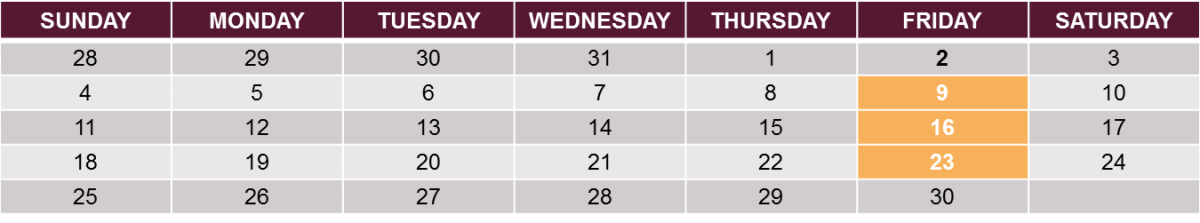

FTSE Russell 2017 Reconstitution calendar

June – transition month

“June is the month that the preliminary reconstitution portfolio is communicated to the marketplace. Beginning on June 9, preliminary lists are communicated to the marketplace and updates are provided on June 16 and 23. The newly reconstituted indexes take effect after the close on Friday, June 23.” [source FTSE Russell, June 2017]